2026 Preview

A look at the year ahead

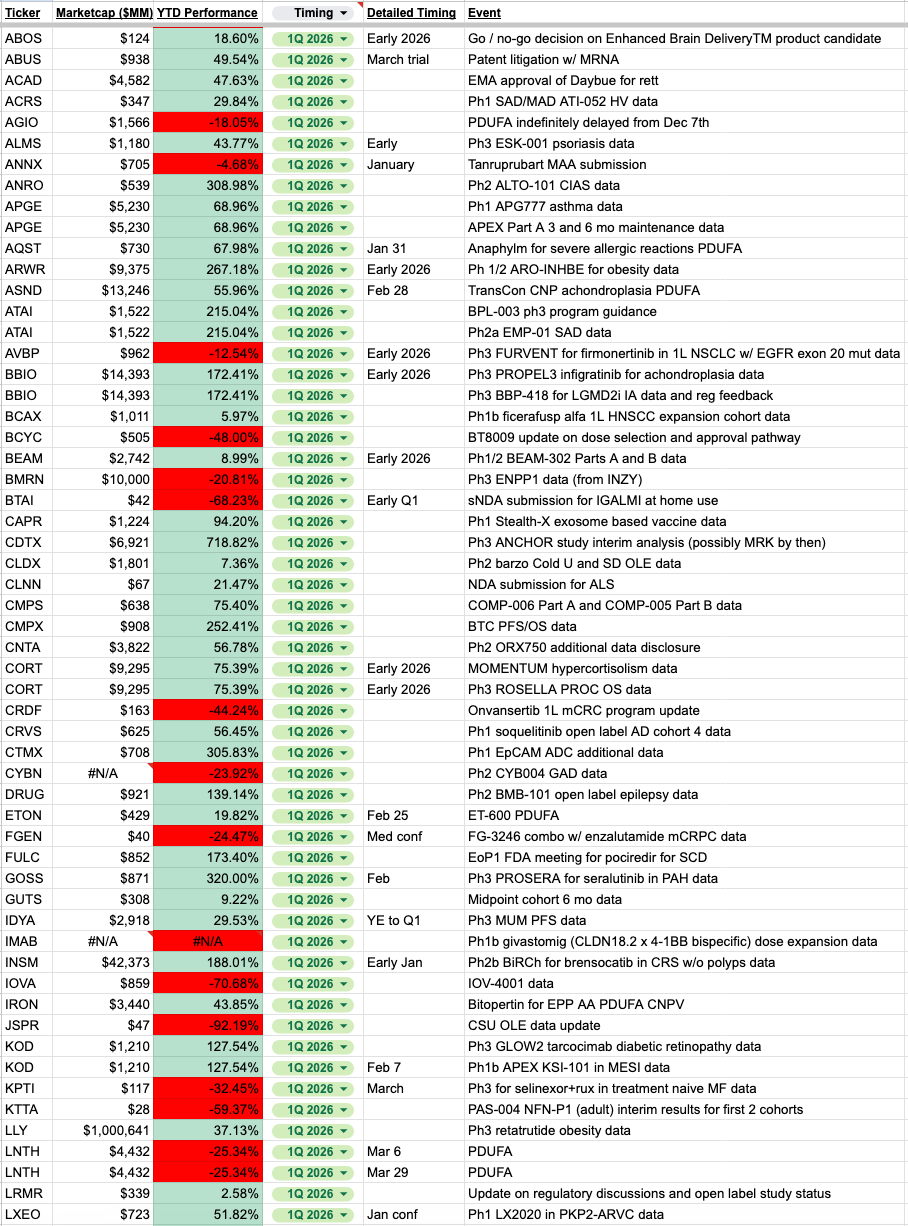

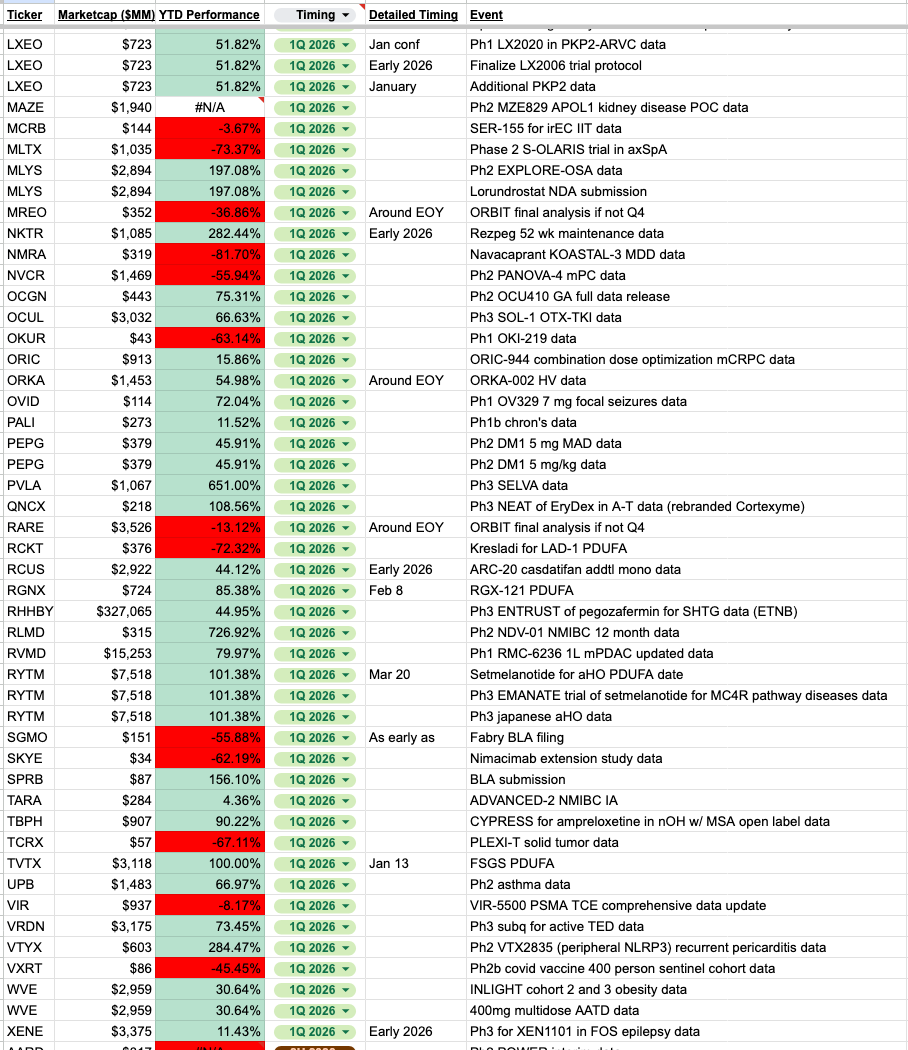

My catalyst sheet has been updated now to include 425+ events for next year so far. This year’s sheet ended with 486 for reference, so I’d expect it could end up being a bit larger. I tend to find some more, and/or more events are added to the calendar as the year goes on. I’ll highlight a few top catalysts that I plan to cover, and then link my sheet at the bottom for paid subscribers. The Q1 portion of the list is attached below to give you an idea:

My Catalysts of Interest

GNLX — Ph3 PROC data coming in the 2nd half of the year. PROC has been really tough for everyone except for Immunogen in recent years, as have oncolytic virus based approaches for cancers other than NMIBC. I plan to dig into this one as it approaches next year.

VTVT — Ph3 cadisegliatin T1D data coming in the 2nd half of the year. This company has been around for a long time, and used to be a neuro company. Now they are testing a diabetes cure!

DMAC — My prior writeup is available here. It has since been delayed another year to the back half of 2026, but my views haven’t changed at all.

More Conventional Catalysts of Interest

GOSS - Ph3 PAH data due in Q1. This is getting, and will get, a lot of attention. PAH is a very large indication that historically has had room for multiple branded therapies and combo use. The original imatinib hypothesis has garnered a ton of attention and debate over the years, and spawned a handful of biotechs as a result. IKT is another one that just got a PIPE done. AVTE didn’t work out last year, it’ll be interesting to see if yet another iteration of the hypothesis can!

XENE- Ph3 epilepsy data due in Q1. This has been on many consensus M&A lists over the last few years. The ph2 dataset was quite impressive and popular. In my view, the only reason for interest to have ever really ebbed in this name would have been the timeline, which obviously is not an issue now. I’m interested to see the upper bound of where people think the stock could trade, but I think this would continue to be a consensus M&A name upon positive data.

CTMX- Ph1 EpCAM ADC additional data due in Q1. The stock has remained relevant despite the possible safety hiccup earlier this year. Efficacious ADCs always play, to the point that there aren’t many examples still left in the public markets to point to! This is especially so for novel targets. This is another one that I’d expect to see a ton of interest, at least if folks feel the Q1 update appropriately derisks the program.

I’ve attached my full catalyst tracker below, hope you enjoy!