Stop me if you’ve heard this before, but I don’t think this is going to work. The POC data for BTC here is a small trial run out of a couple sites in Korea, which makes population comps more challenging/unreliable. The company wants to compare the data like this:

Much smaller sample size, but theoretically some ORR benefit. This notably does not translate to 1L OS comps, and to me, PFS underwhelms as well vs their 1L comps, though it’s numerically superior. I think the proposed effect size could be driven by differences in the population. We have seen plenty of examples of cancer data generated overseas that doesn’t translate, most recently with Elevation now. Additionally, this is also likely the first Paclitaxel exposure for some patients in the trial, so it’s entirely possible they are responding to that (though at a higher rate than you would expect).

Patients in the Korea trial received paclitaxel in combo with their CTX-009 regimen. It’s very important to note that for many patients, this was their first exposure to Pac, which is again going to confound population comps even further. It looks like almost everyone received Gem/Cis as their 1L and only systemic treatment. Presumably about half of them have certainly not seen Pac, maybe more depending on how diverse 2L treatment is at these centers in Korea. Controlling against Pac mono in this upcoming readout, if initial Pac exposure is driving some of these responses, that will just cause both arms to mildly outperform and create no separation.

I also have issues with the US data, which is primarily for CRC/gastric cancer. The notion that monotherapy should produce a few responses here, and then not at all in the combo data for those same cancer types, is really bizarre to me.

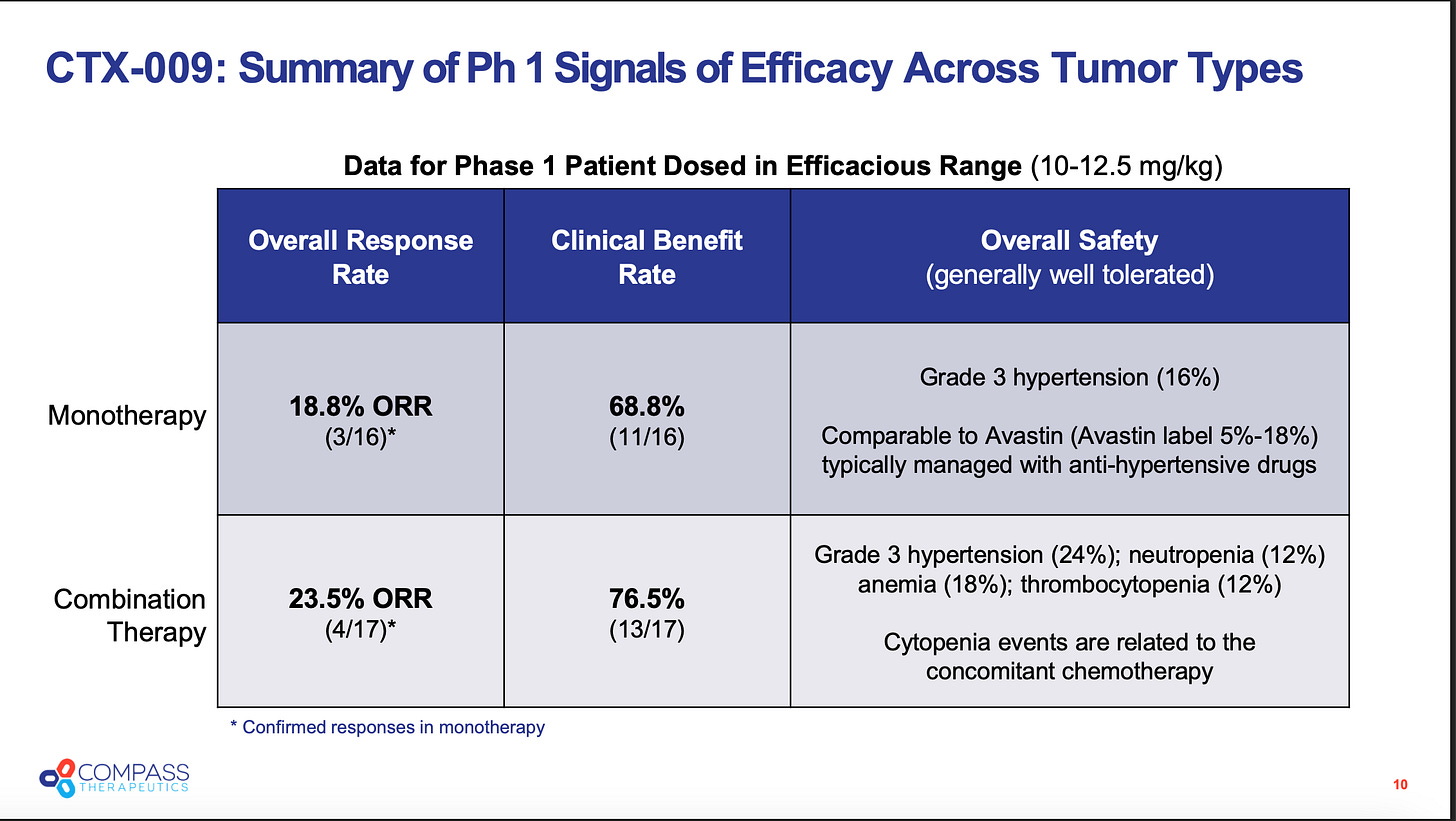

They didn’t enroll enough combo patients for this to definitively be an issue, but with 6 CRC/gastric patients enrolled, and proposed ~20% ORR’s, you’d certainly expect to see at least one combo response if CTX-009 is supposed to be active in those tumor types! There doesn’t appear to be any monotherapy data for BTC, you have to rely on the Korean combo data w/ Pac, and this US combo data that appears to conflict with the mono data. I don’t find either to be particularly convincing of drug activity, I think the combo data calls into question whether or not the mono ORR should be interpreted as an active drug. It also looks like they’re trying to cut the data as if there’s a U-shaped dose response, calling the efficacious range 10 to 12.5 mpk even though they have mono tx data from 15 and 17.5 mpk, and a response at 15 mpk even. I have a hard time believing that.

It also doesn’t help for the upside case that it sounds like this update is going to be ORR only. I think this is not a massive upside event. Given the discrepancy between the POC data on ORR and PFS/OS, even if the ORR data replicates, the full data will remain an overhang on the stock. To the downside, deciding how to value the preclinical PD-1 x VEGF is a bit confusing. It’s not something I care about personally right now. I think there are more appealing ways to seek that type of trade, Instil would be a further along small cap for example, likely subject to many of the same whims that would drive a CMPX trade on it. But I get why it makes sense to respect the possibility that people will care about the asset, and not automatically mark downside to ~50% of cash, or whatever your preferred going rate is. Something in the 0.75-1.00 range is probably about right if the dataset is a clean fail, but I’ve heard varying takes on this, and wouldn’t have much of an issue if the stock did completely break.

I don’t think I have much else to add, pretty simple holes to poke, but historically that’s served me pretty well for these types of oncology trials. They’ve pushed this out a couple of times already, but doing so again after confirming at earnings a month ago seems like a stretch. Feels like it’s been a little while since I got my last fun binary fix, so I look forward to seeing this very soon!

Good write up 👍

Would love your perspective on eXoZymes Inc!

https://www.slack-capital.com/p/exozymes-research-report