DMAC (Short) Q4 25 IA

Post-hoc analysis of a synthetic urine protein to improve outcomes in stroke patients

DMAC is conducting a Ph 2/3 study of DM199 (recombinant KLK1 — more on that later) in Acute Ischemic Stroke (AIS). The interim analysis, which has most recently been slated for Q4 2025, will determine whether the trial is stopped for futility (non-binding) or has a sample size re-estimation (SSRE).

Management has not publicly disclosed the threshold for futility, but I very much expect that DM199 will fail to separate from placebo. I’m not sure whether this is reflected through futility or a very large SSRE will ultimately matter much. The trial began enrolling in 2021, albeit hampered by a <1 year clinical hold and slow site reactivation, but it’s taking a very long time to enroll. If they have to enroll say, 600 total patients, and it’s taking them 3-4 years to enroll the first 200 (with the above caveats, and alleged enrollment acceleration going forward)… that’s a lot of cash burn in their future. I will say they haven’t disclosed the formula for effect size to SSRE size, and it’s not completely clear to me right now if they plan to disclose the effect size at the interim alongside any SSRE or not. This is the extent of what the most recent update gave us:

This would be more of a potential issue with my thesis if they were better funded, but as previously explained, I think a large SSRE is already informative and problematic enough regardless. Enough about the catalyst setup for now, what I really want to dig into here is the treatment, the mechanism, and the ph2 data.

Let’s start at the beginning with their S-1. They did a $16M IPO in 2018 through Craig-Hallum, as all the best and brightest that biotech has to offer always do, of course. They describe DM199 as a recombinant form of KLK1.

What they go on to say after is much more important:

Forms of KLK1 are derived from human urine and sold in parts of Asia to treat various diseases. The company has run analyses that demonstrate DM199 is structurally and functionally equivalent to KLK1 derived from human urine. They also note that they believe this has (unsuccessfully) been attempted at least 5 times prior. This sounds like an incredibly odd approach, and it also hasn’t worked in prior attempts.

The proof of concept data they provide for KLK1 contains pretty clear chart crimes:

Also, the Barthel Index endpoint they use is not Diamedica’s Ph3 primary endpoint, nor was it shared in the Ph2 slides, though per clinicaltrials.gov, the data was collected…

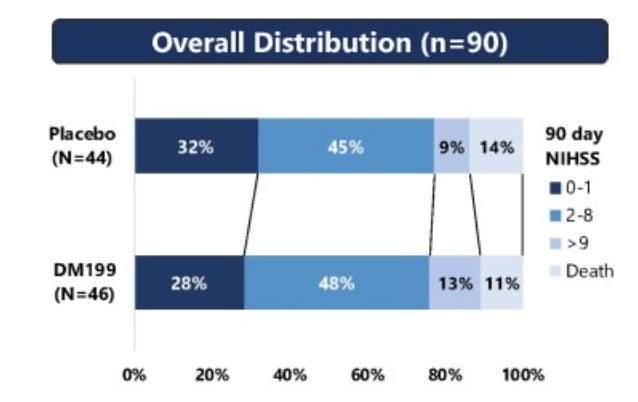

The Ph2 topline and the slides are all a mess. The trial failed to show efficacy benefit vs placebo in the pooled population:

What they want to do is subgroup the data to exclude patients who received a mechanical thrombectomy, which was just under half the trial population. It’s also worth noting, going back to the S-1 again, that they used to claim benefit should be additive for patients who had received a mechanical thrombectomy.

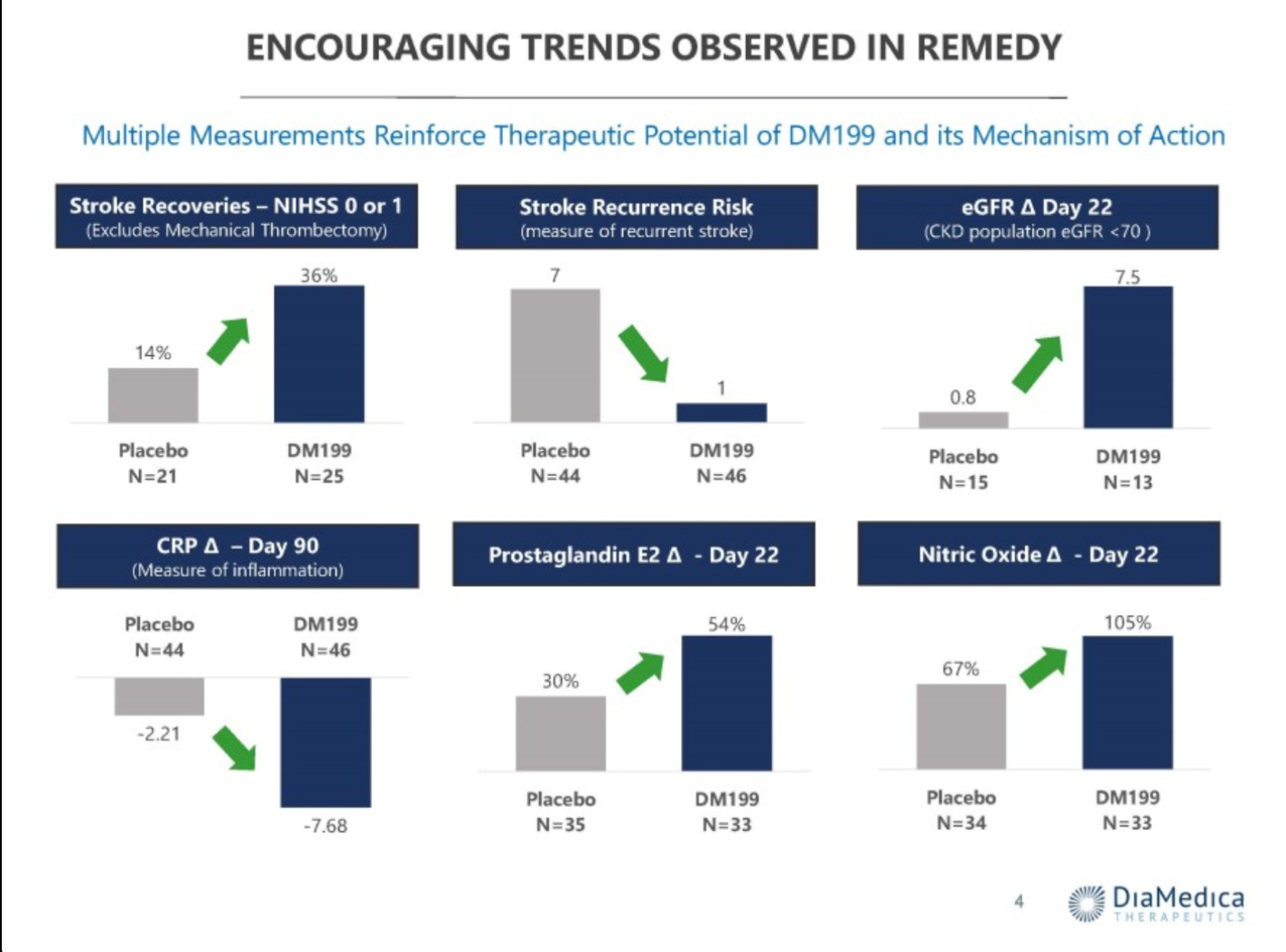

The Chinese study that they reference in the ph2 slides as a comparator is a retrospective and single-center study, which is of very limited value to me. I think Diamedica presents their own data in ways that can be misleading, this particular slide below is my favorite example.

Recall, this was a 90 patient study. Yet all the sample sizes change, both by different amounts and for different reasons. Cuts are taken at different timeframes and/or not given, the whole thing is just a mess. Nonetheless, they continued to push ahead. This ongoing trial made changes to exclude the mechanical thrombectomy patients from enrolling, you can see the design (numbers not yet updated for interim design changes) below.

The recent changes to the trial design are based on an even smaller subgroup from the ph2 regarding the primary endpoint of this trial, whereas previously the NIHSS was the point of emphasis (concerning as well) — though it was not technically the ph2 primary.

To summarize, this all looks like a bunch of slice-and-dice nonsense to me after a failed Ph2. I think the proposed validation they provide for the mechanism is weak, their own trial data is not very supportive, this trial is highly unlikely to show a meaningful effect size vs placebo, and a large SSRE would also be quite negative news. It’s a bit early to put a trade on, and I want more color on what we should expect for efficacy data at the IA. I also have a general preference for options on these smaller RCT fails when I’m able, and those aren’t even available this far out yet. It’s not particularly liquid either, but under current conditions a ~200m mcap is probably toward the upper bound of what something like this trades at. Pretty rare to see this type of thing over a 250m mcap now without some particularly extenuating circumstances. Anyways, as I start to fill out next year with high-conviction events, this is one I gravitate toward and would expect to be able to trade closer to data.

Would love to hear thoughts/feedback/etc.