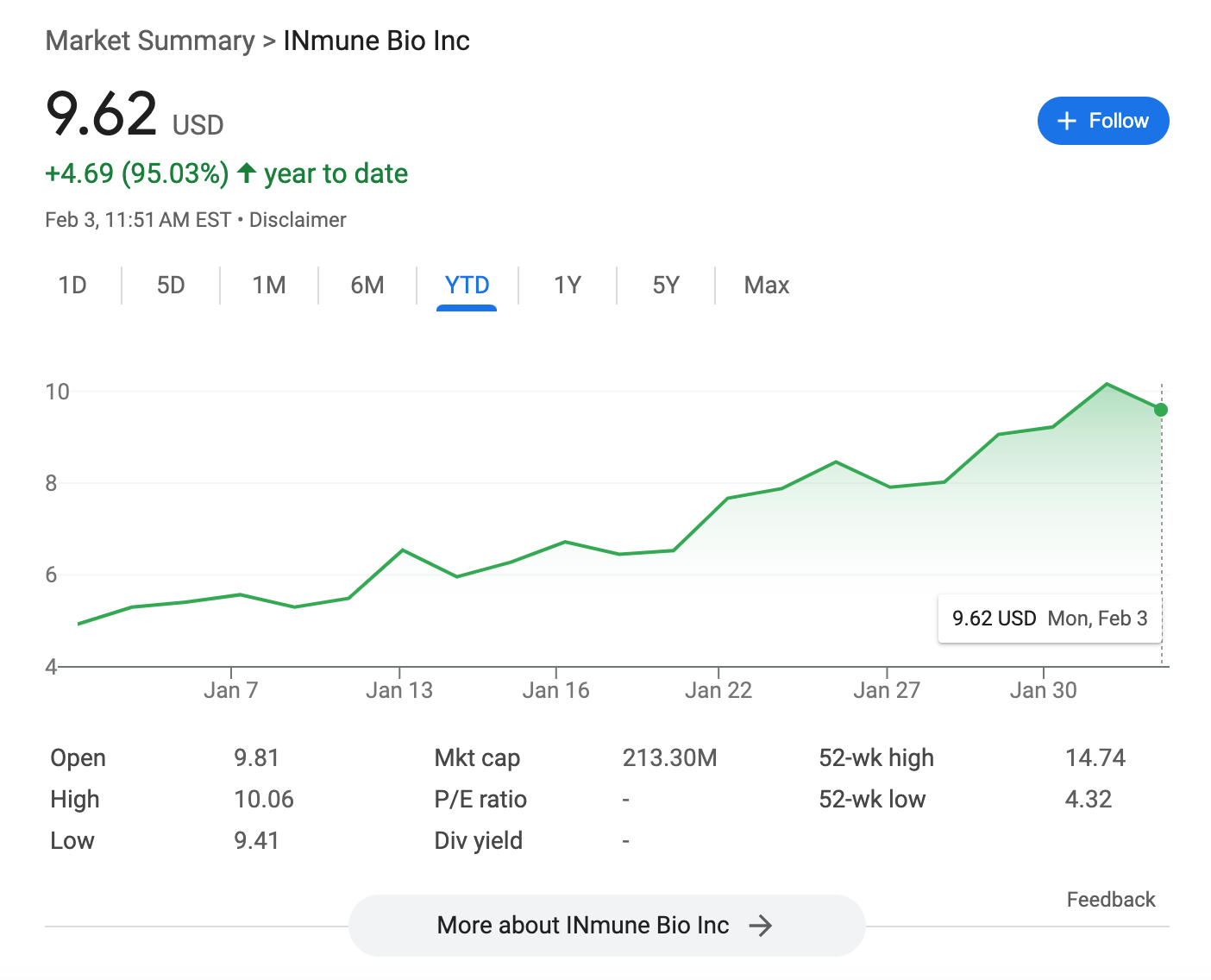

INMB has run up nearly 100% YTD, in anticipation of their Ph2 alzheimer’s readout in Q2. The company had just over $30m in cash at the end of Q3 last year, burning over $10m per quarter. If additional funds are not raised prior to data, the downside case upon failure should be to less than $1.00.

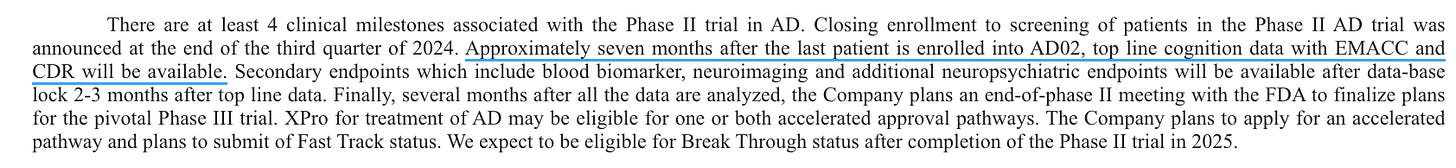

According to the Q3 10-Q, we can expect topline cognition data seven months after the last patient enrolls. The company says the last patient was randomized Nov 11th, and has guided for Q2 data release, so presumably early June.

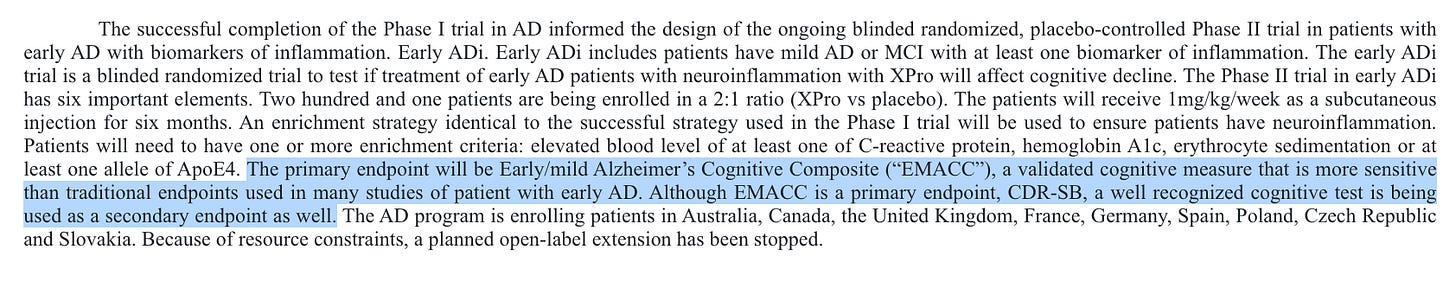

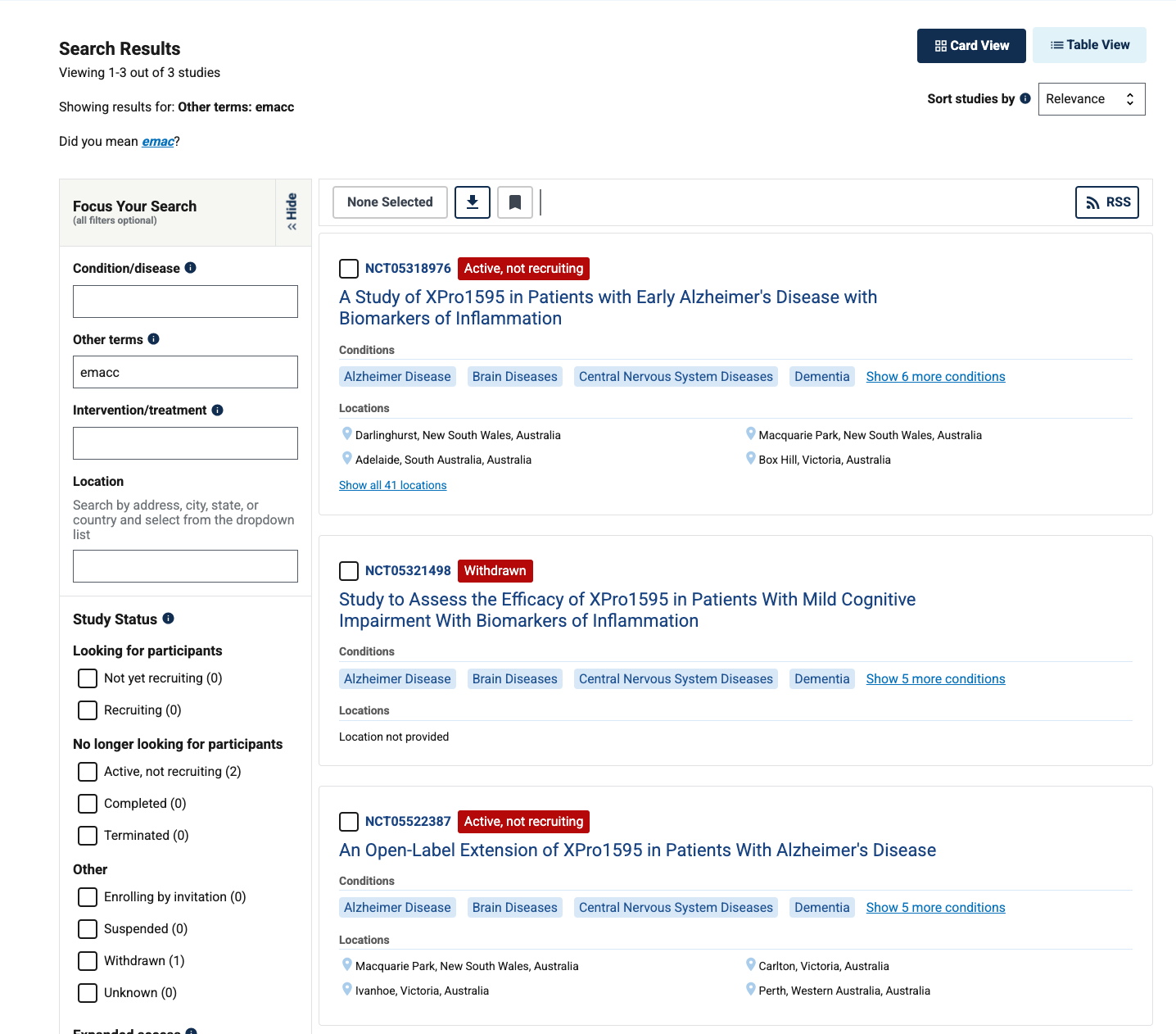

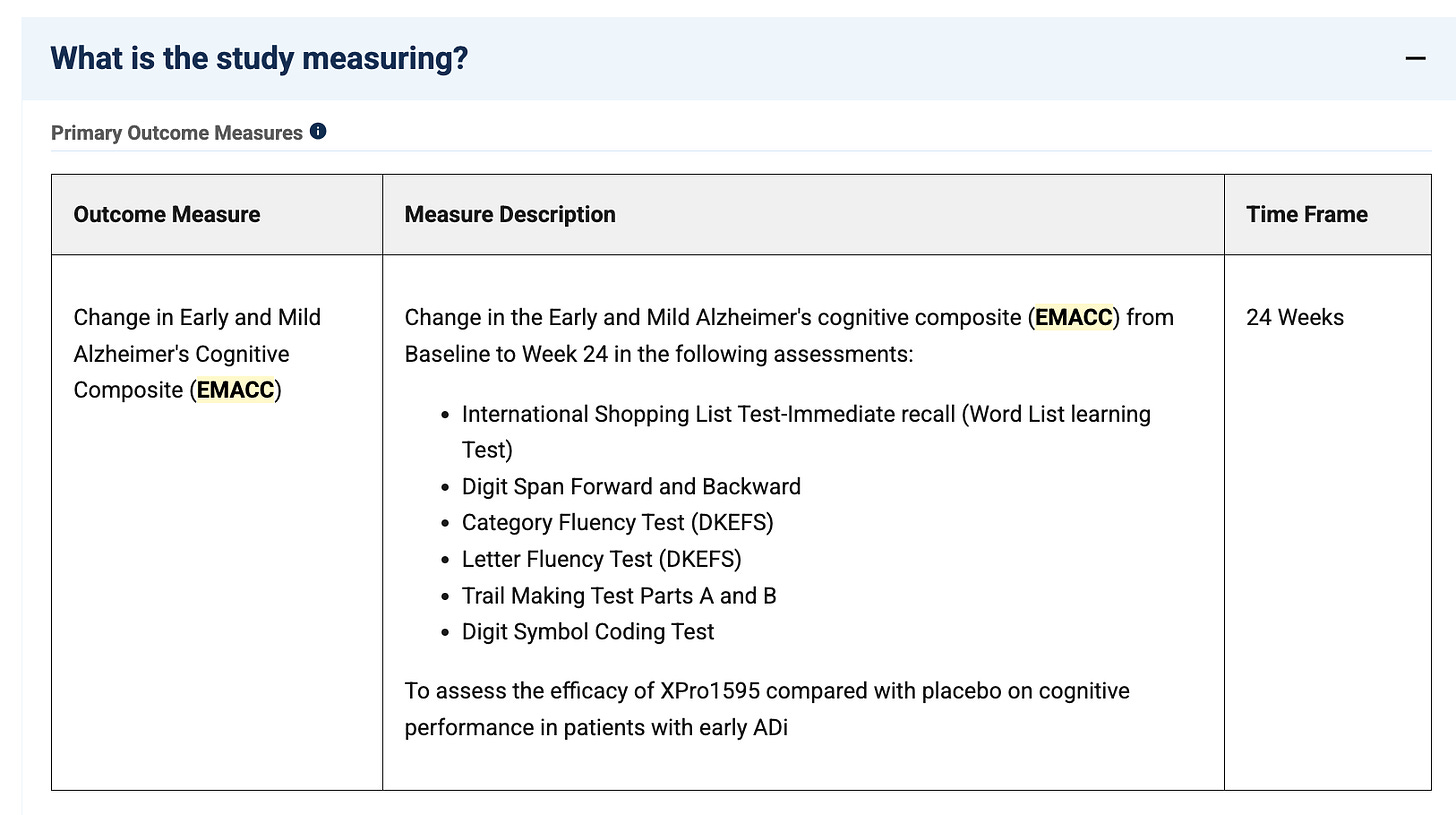

The company plans to share cognition data for CDR-SB, a commonly used cognition endpoint, as well as their primary endpoint… the EMACC?

They claim this is a validated measure, but a quick search of the clinicaltrials.gov database shows that the only trials mentioning this endpoint are their own.

.I would be curious to hear more about where this has been validated, could be under a different name or something I suppose. They do at least tell us the test components, and for the most part these look to be easily measurable components, so I don’t think it’s a huge issue. The company saying they plan to share both endpoints at the topline is great, I think they’ll need to show a clear effect size on both for this to be taken as a success.

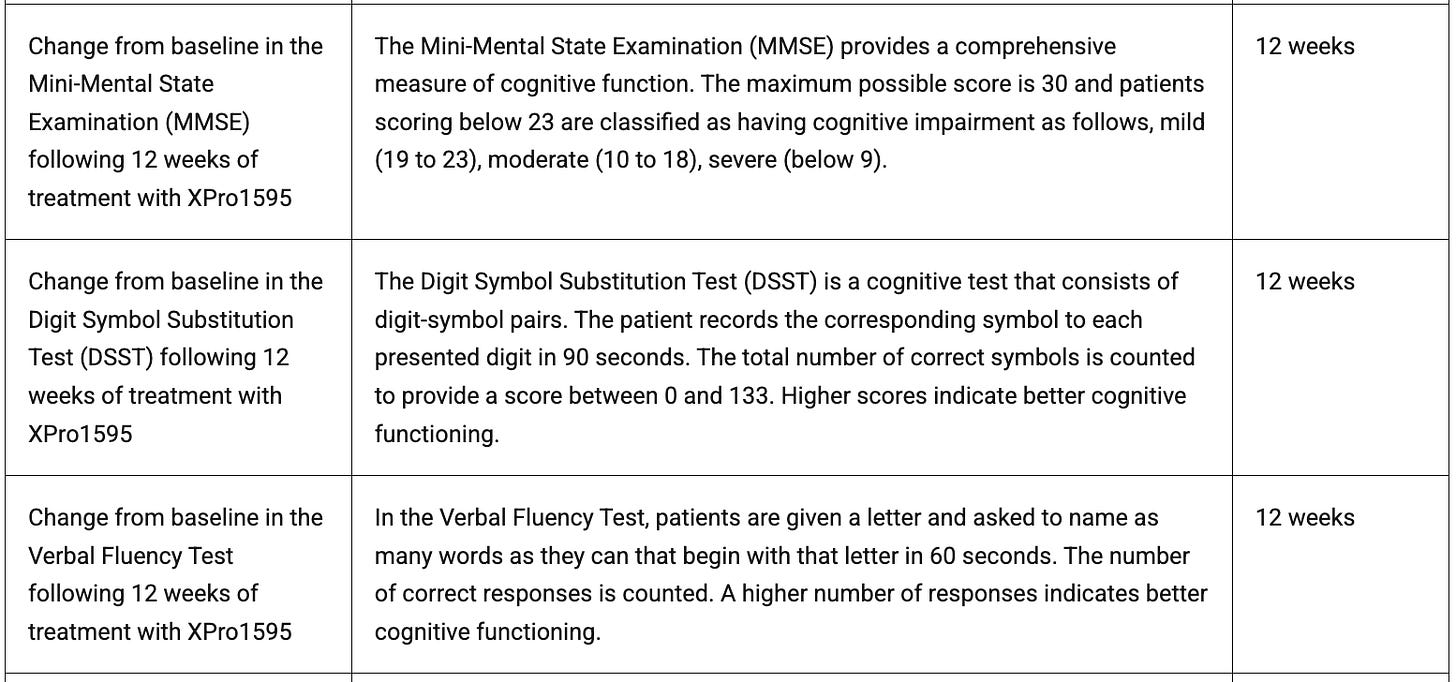

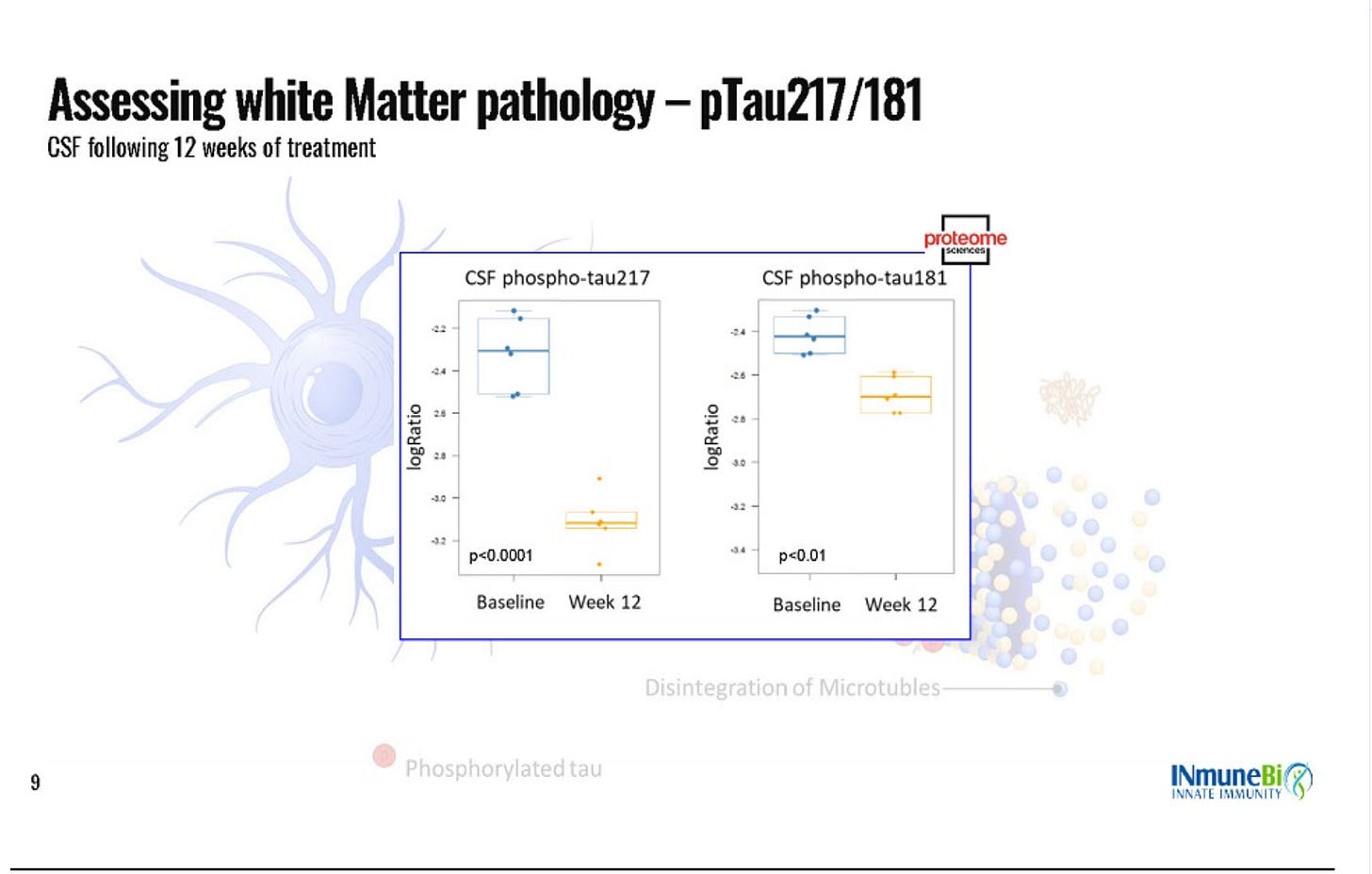

I am skeptical because the Ph1 data and slides are a complete mess. First of all, the primary endpoint of the study was TEAE rates, which they don’t address anywhere in either disclosure. They have a whole slew of biomarker secondaries, as well as various cognitive and QOL measurements. They selectively disclose biomarker data, and I don’t see any of the cognitive and QOL data, including MMSE (common cognitive endpoint), and the verbal fluency test, which would have read through to the EMACC. This data was toplined in 2021 and they never published it with the full data, which does matter particularly with their cash needs. They had to stop the OLE for financing issues, the stock price is clearly hindering their ability to collect all the data that they want to, and yet they are obfuscating their existing data.

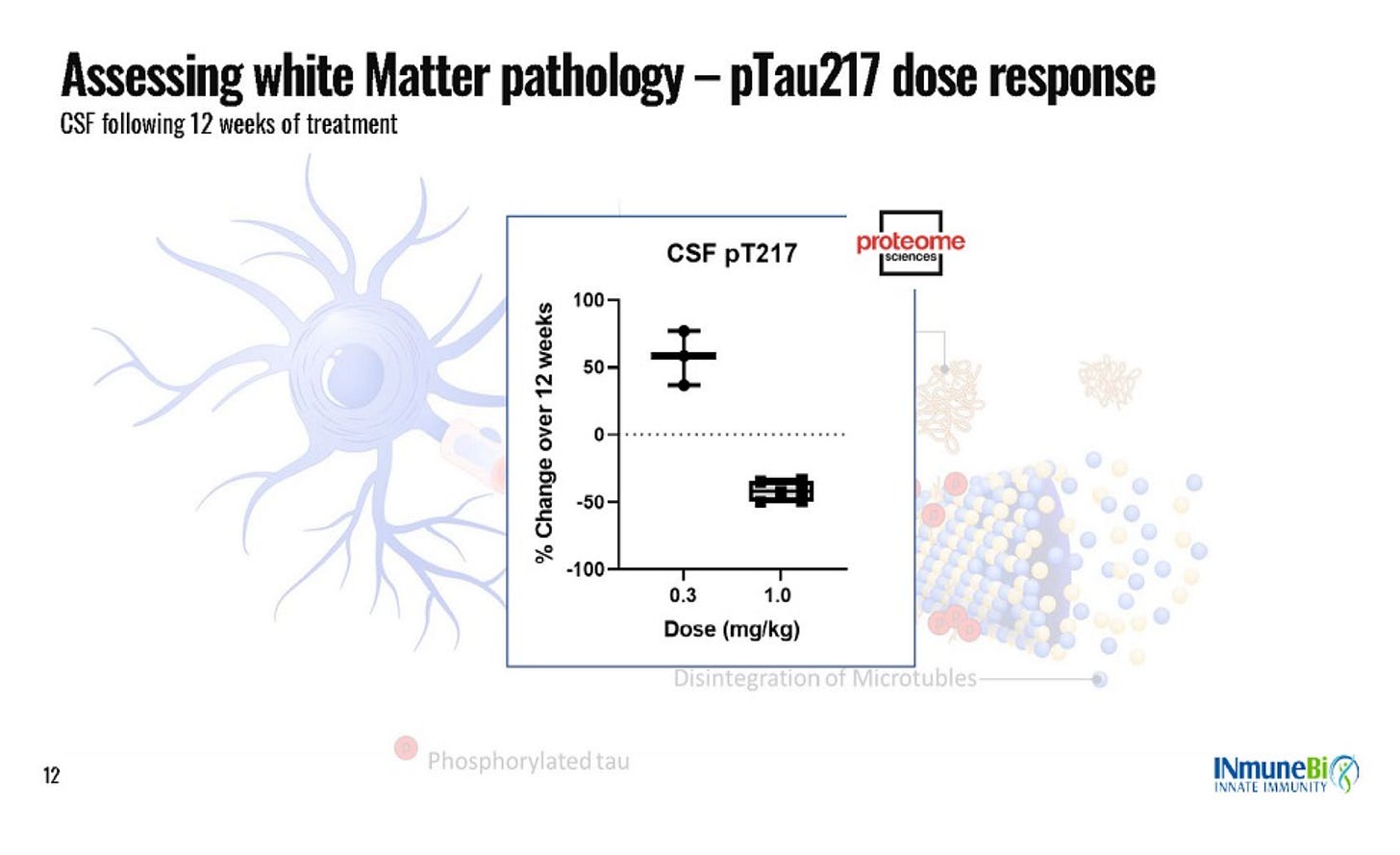

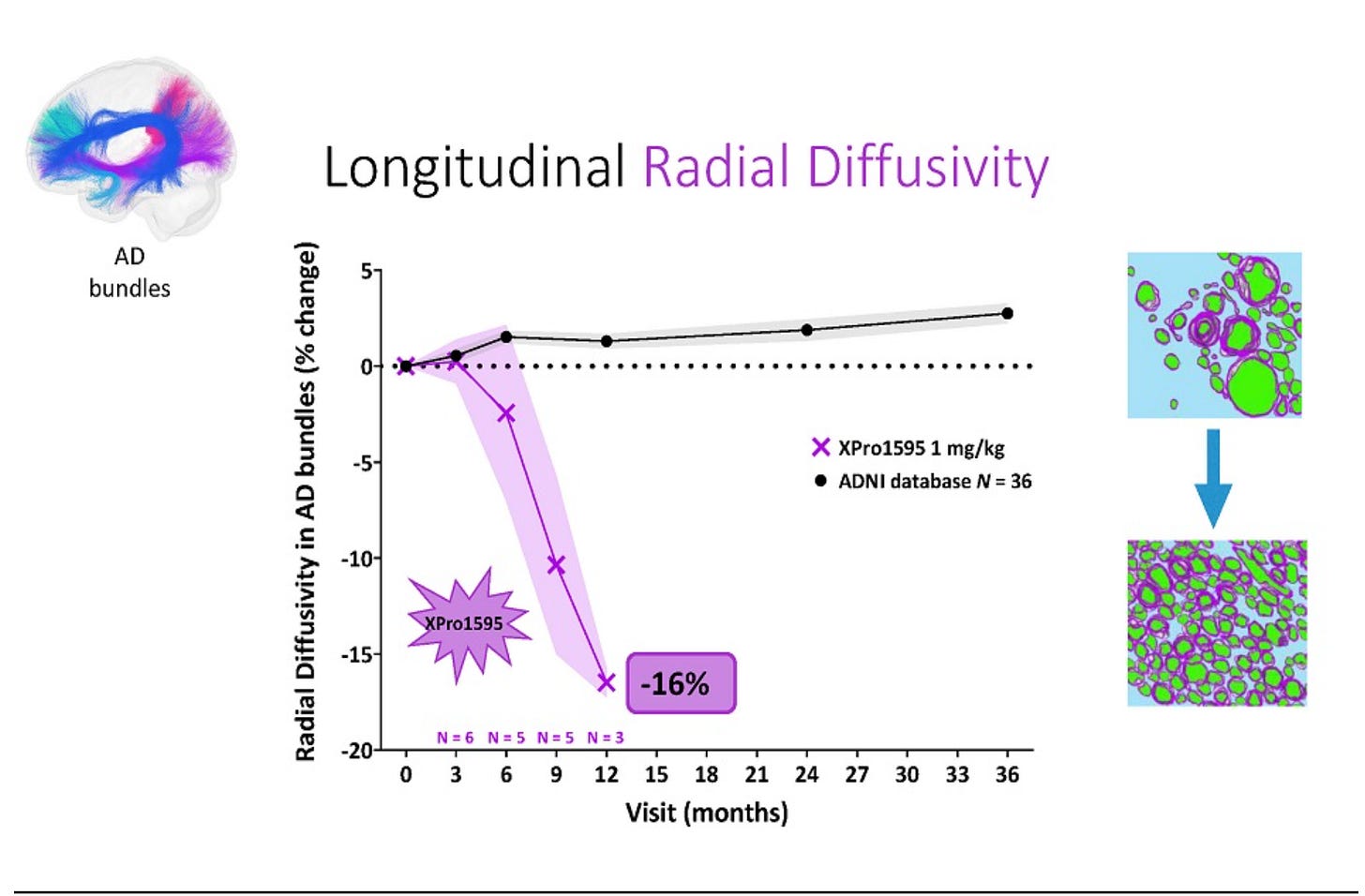

The data that they did share in the slides also doesn’t make much sense. Very few slides show the data from every dose level, some clearly only show one dose level but don’t even tell you which dose level it is, for some of the biomarkers they pull in an n=36 external database and they only comp it to the high dose. The baselines (which they only have for completers???) are wildly imbalanced, the low dose is entirely mild patients. The 16% radial diffusivity claim in the press release is from the 12 month extension data which is only n=3, and lower dose data is not shown. Here are a few examples of what I am talking about:

Dose not mentioned (I think it’s 1 mg?)

… what?

Where is 0.6 mg/kg?

If n=3 data at 12 months from a 12 week study is enough to make a 16% claim in the press release, why not comp the other dose levels here too? Surely that data is also interpretable?

To be clear, I don’t think it would be fair to expect a trial this small to show an extremely clear benefit on all of the endpoints, but I think that withholding data and in some ways misrepresenting it speaks more than enough for itself. I think the ph2 endpoints give a lot less wiggle room to obfuscate, and that the market will be quicker to punish data that is not clearly positive in the entire population, particularly on CDR-SB. I think this a pretty short and simple thesis, but I don’t see what’s worth following up on in more detail. I see a stock that has run up with a financing need, fundamental surface-level red flags that do not check out, and I think this is a simple readout with a clearly defined bar (success on CDR-SB).

Pretty much all statements are incorrect. My reply here.

https://carlkestens.substack.com/p/short-reply-to-biotenics-short-thesis?sd=pf

My DD on the company is shown on www.thetyp.com. Give it a look. Perhaps I'll comment on some of your brief points one day :).