IOBT is running an RCT in melanoma of their peptide-based therapeutic cancer vaccine targeting IDO. This target is often mentioned alongside the likes of IL-2, CD47, TIGIT, etc. It was a very high-profile target, almost 10 years ago now, that failed in a number of phase 3 studies such as this one from Incyte. It performed slightly worse than placebo in a Keytruda combo for metastatic melanoma. So they’re taking what has historically been an unsuccessful target, and delivering it in the historically unsuccessful form of a therapeutic cancer vaccine. Given all of that risk, surely you’d want to design a clean and derisking proof-of-concept study, right???

Alas, the data we have to go by is single-center, and looks a lot like PD-1 naive patients responding to PD-1 treatment, as both were given in combo to melanoma patients.

PD-1 naive patients clearly respond in Arm A, while no patients who previously progressed on PD-1 treatment respond in Arm B, and some patients with PD-1 treatment exposure who progress off therapy will respond in Arm C. That’s exactly how I’d expect a small sample of PD-1 treatment to look. It might be unfair to ask for a response in an n=10 PD-1 progressor arm. However, given the trial's design, that’s really the only place one could look to see signs of treatment activity independent of PD-1. And we do not see any. While the Arm A and C ORR percentages may appear to be impressive, I don’t think n=4 from Arm C makes for an interpretable dataset at all. As for Arm A, in the publication, they are claiming this 80% ORR is impressive vs. 42% for a matched control, but I have my doubts about that being the right comparator. If you go back and look at the initial IDO data that had people interested, that’s a multi-center dataset with a nearly 50% larger sample than IO’s, and a 61% ORR.

80% is still better obviously, but when considering sample size, trial sites, the Arm B data, and the history of the mechanism… I think it’s just a small, abnormal sample that swung a little high in a situation where each patient is more likely than not to be a responder. The market seems to agree, as this is valued at <100m market cap.

The ORR criticisms are likely fair, as the controlled trial missed its ORR interim last summer. Granted, they said in a presentation days later that it had a very high bar, p=0.005. However, that’s not necessarily unattainable for a ~225 patient analysis that, according to their own publication, was previously supposed to be doubling what is already a fairly sizable response rate. It’s also important to note that I see no references anywhere to a futility component of this analysis, so continuing the study isn’t inherently derisking at all either.

As for the PFS data, since that’s the phase 3 primary endpoint, they’d surely point to this 25.5 month figure from the POC data as an outstanding number. My counter to this would be that patients in the trial were only treated with the vaccine for the first 12 months!

They were allowed to continue PD-1 treatment as long as there was clinical benefit, which was obviously longer than 12 months for many. So again, I think this is great data for PD-1’s, but it’s also impossible to comfortably attribute this data to a vaccine treatment effect. Patients who achieved a PFS near or above the median would have spent more time on PD-1 monotherapy (>12 months) than they would’ve on both treatments (12 months). How are we supposed to attribute that to IOBT’s treatment?

The phase 3 design is fairly straightforward, open-label, randomized 1:1 combo vs Pembro mono with a PFS primary endpoint. The most relevant changes would be going from Nivo to Pembro and combo dosing allowed for up to 2 years. If the vaccine is contributing, extending the protocol to allow dosing for a second year certainly would give them a better chance to show that, my guess is just that it is not contributing. I don’t think open-label matters much in the context of ORR/PFS type endpoints. Missing the ORR interim would tell you that wasn’t a blowout positive outcome due to a lack of blinding anyway.

Another note about the trial would be that it was initially guided to read out in the first half, but has since been delayed to this quarter due to event accrual. In my experience, a trial like this where you have a missed interim analysis getting extended for event accrual… that’s bad. It’s likely a product of underestimating control arm performance. If events were taking so long to accrue because the drug is working so well… that likely shows up in the form of a blowout positive interim ORR. Which didn’t happen, obviously. In presentations, they will reference approved drugs that show PFS benefit but not ORR. But, they don’t really get into why this would happen with their drug, particularly in light of the proof of concept ORR data in theory being so good. I think this is a critical part of the story that is not adequately addressed.

The valuation here is definitely on the lighter side already, I’d argue as it should be. But it’s important to note that the stock would be up a few times over on a clean win. and at least currently there are no options. Position sizing has to be a major consideration given the upside, even with strong conviction, so this certainly is not for everyone. The share count looks like this:

65.9m shares outstanding, and then on a win there’s 37m warrants at $2.40, plus 8.9m stock options and other 5.6m warrants from the first debt tranche, for a total of 117.4m, so the fully diluted share count is much higher, but none of that will come into play should the trial fail. It’s a bit under 100m mcap here in the 1.40’s, based off just the 65.9m shares. Their finances appear to be in pretty rough shape. They guide for cash into Q2 2026, as you can see here:

Almost a year of runway for a biotech with a risky readout like this isn’t awful, but note that this guidance includes drawing 3 loan tranches, of which they only have one so far. The third and largest tranche also requires raising $50m cash and submitting a marketing application for the drug.

I think this will limit their ability to spin the data or look at one specific stratification or something along those lines. It also means that in the event of a fail, they won’t receive it. This will meaningfully shorten their guided cash balance. I’m not sure if the bank can claw back either of the first two tranches based on how this is worded below, though they may want to try to.

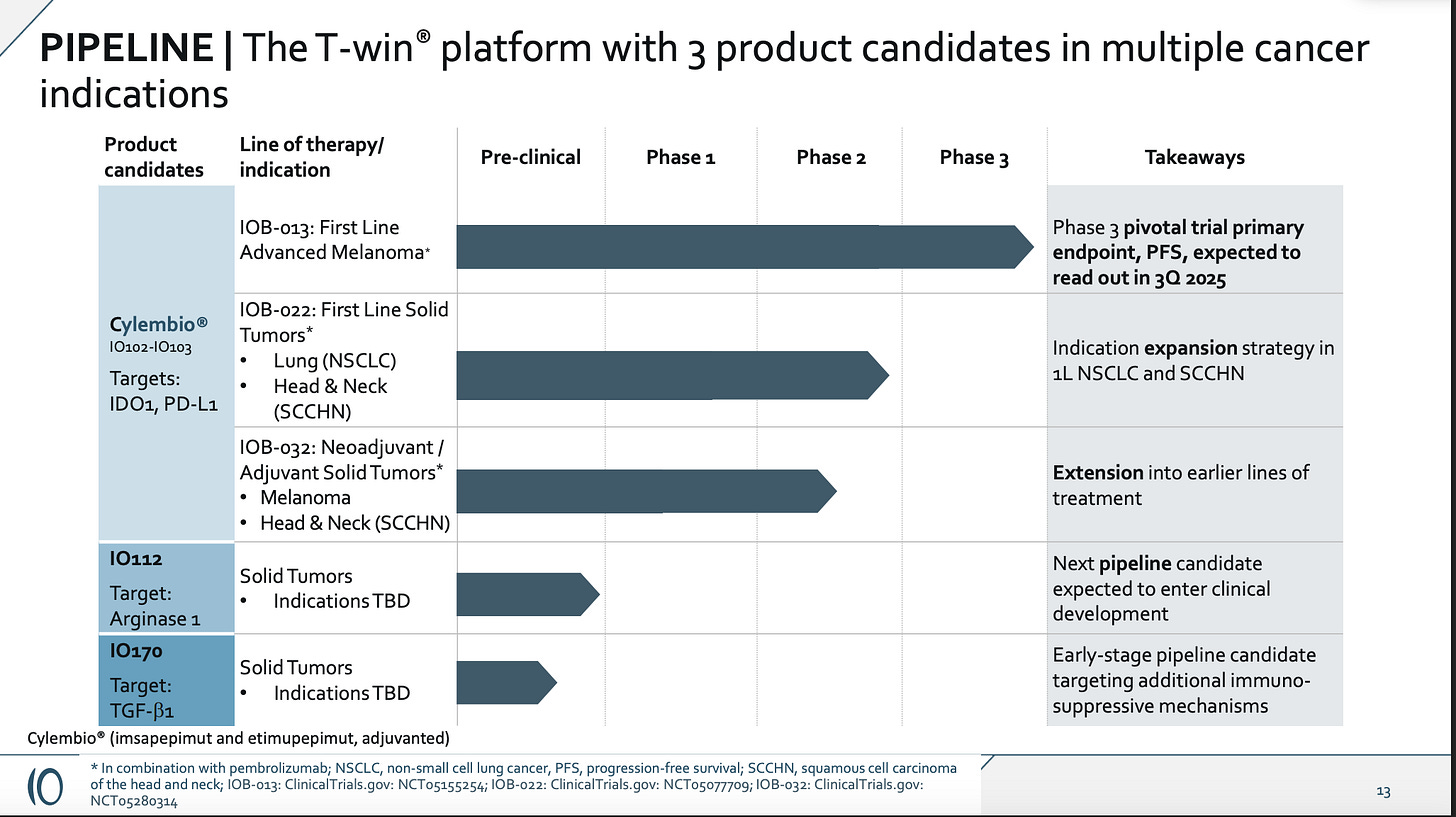

It’s probably more like runway to end of the year on a fail, and this is their only clinical stage asset per their slides:

I don’t expect the market to ascribe value to the other indications after a failed controlled study, nor to preclinical candidates without a targeted indication. I think it will be incredibly difficult to raise any further capital, and whatever they can scrape together, they may end up oweing to the bank.

Some people will look at this and see an explosive, high-risk readout. I see a stock with a very high chance of trading near zero, and not very long from now. Again, there are no options, so I feel like exercising caution in sizing is important. There at least appears to be a cheap and reasonable amount of borrow, though trading volume here is on the weaker side as well. It doesn’t scale well, and it’s high risk, but I think the pitch here is pretty strong. I look forward to seeing the data hopefully sometime this quarter!

So u are shorting it?