RPTX

A catalyst and strategic alts hybrid trade

This name was first mentioned by the Biotech Bonanza Substack, which is great and has a similar style to some of what I like to do on the long side. You can subscribe below if you have not already.

I think this deserves its own write-up, but there’s not much to it. It’s a bit of a blend between a PMVP-type catalyst trade and a strategic alts trade. They are selling off assets, have an ongoing workforce reduction, are evaluating strategic alternatives, and also have multiple POC readouts in Q4. I am most interested in the strategic alts, but there’s also a low-risk shot at a couple of datasets along the way.

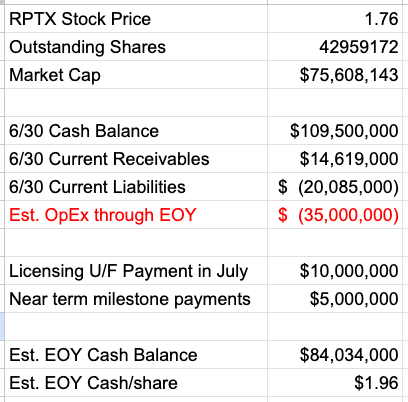

I’ll start with valuation. I think this is worth around $2 at the end of the year if they take a favorable route with the cash.

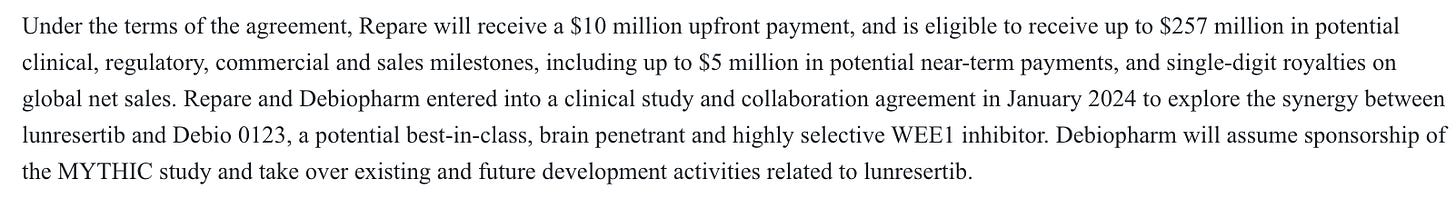

The licensing deals they’ve done this year are a positive sign, and an attached CVR for the milestone payments would have a bit of value, though it’s hard to determine more precisely without the exact milestones broken out.

They retain some future upside here through $257m in milestones and a single-digit royalty. Definitely low POS, but it would have some value as a future CVR distribution if they are winding up the company in a couple months, which I think is reasonably likely.

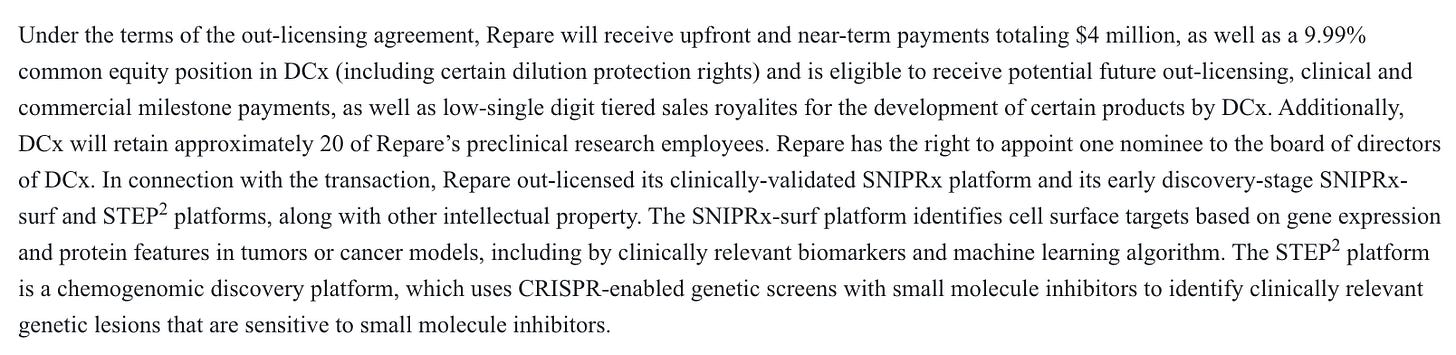

They also sold their clinical development platforms, which both decreases the likelihood of burning future cash on something new developed in house, and retains a bit of future upside. In this case through an equity stake, undefined milestones, and another small royalty. I think this is a lot less interesting than the concrete milestones above, but I don’t think there’s value ascribed to any of it, and again, if they’re going to be rolling it into a CVR that I haven’t paid for, then great! They were also able to sell it to a company who would keep in ~20 of the research employees, which I think is a sign that they are trying to go about this the right away, particularly for their employees, but hopefully also investors. I don’t think that type of arrangment is particularly common in these types of companies that I have looked at so far.

They could also look to monetize one or both of the oncology assets, even lower upfront value deals like they’ve been doing can still be meaningful at this low of a valuation. My thinking is that there’s a nice margin of safety here, and that they’ve been making practical moves so far this year, which at least incrementally increases faith in governance here versus the usual standard. They replaced the CEO with the CFO earlier this year, and the quote in that PR leads with creating shareholder value before mentioning the data catalysts. This is maybe reading too much into the finer details, but I think that, combined with their other strategic decisions and installing the CFO, it all gives you a pretty good idea of what direction they are headed in.

I think pairing this proposed margin of safety with the potential for at least a headline pop here makes for an interesting trade.

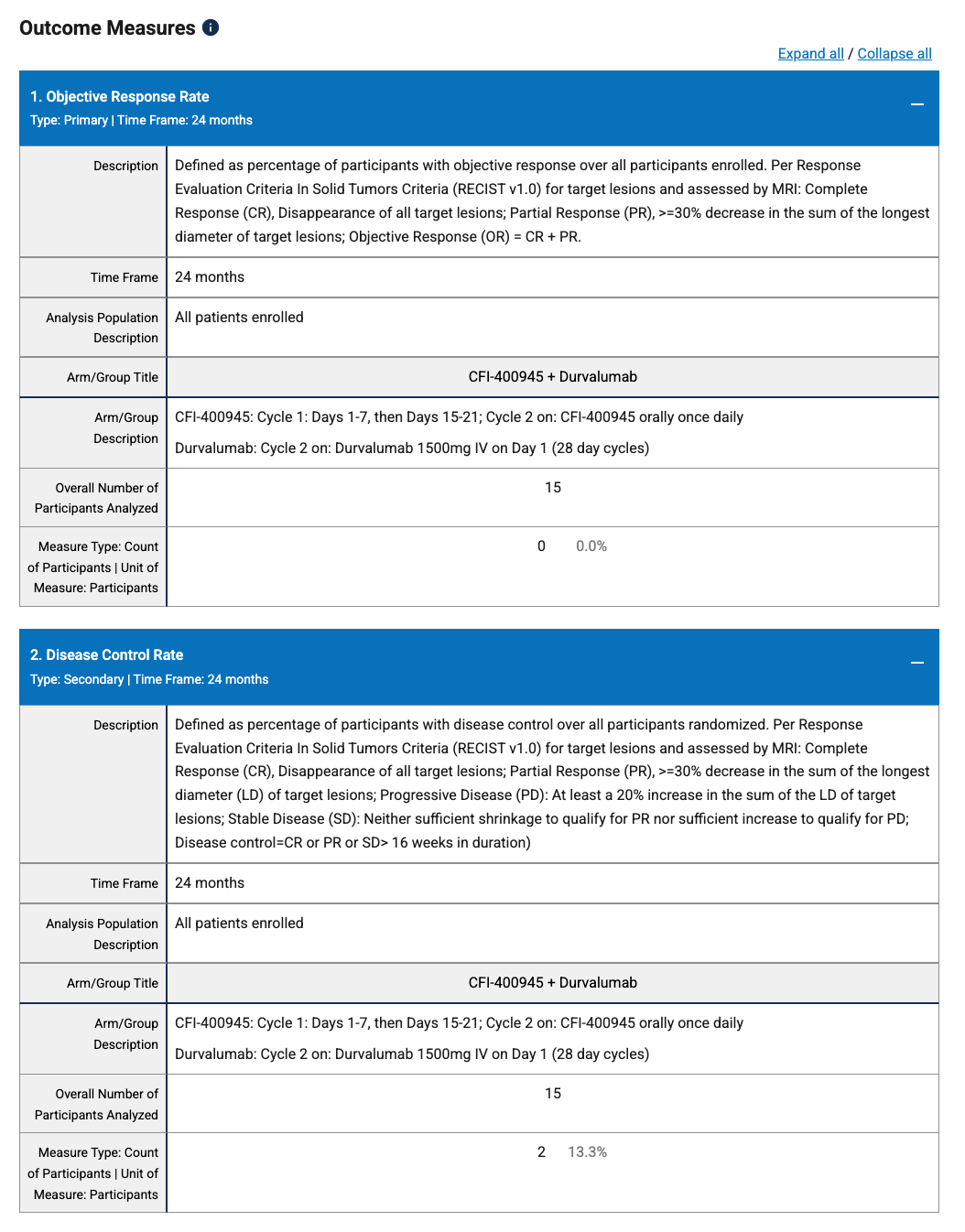

They’re running a combo basket study, sector sentiment seems to be improving, and we could be talking about rate cuts in the short-term. I don’t know how the company aims to slice this, but I think it’s reasonable to expect we could be in an environment where even 1-2 small arms seeing unanticipated degrees of efficacy, which I would argue happens pretty frequently in small n basket studies with an active combo agent, could lead to a sizable move in a name like this.

There are obviously reasons the company is where it is, PLK4 isn’t much of a validated target, and the little clinical data that does exist includes this 0% ORR combo in triple-negative breast cancer.

They don’t have a strong history of developing drugs, and likely the biggest reason these weren’t part of the restructuring was simply their proximity to POC data. But anytime you can get a low-risk look at something like this, with a couple of clear pathways to wins of varying degrees, I think it makes sense to take the swing. Short of doing something like the AADI deal with the cash, I think it’d be hard for this to turn into a big loser, so I like those odds.

Thanks for writing it up! I think what isn´t totally clear on 1st glance is that RPTX did not sell off lunre completely in that Debiopharm deal. That covers only that specific combination if I read the terms correctly.

That leaves the P3-ready lunre/camo still on the books (data has not been stellar of course...) and available for partnering in tandem or in other combinations. Given the very advanced stage and probably comprehensive data package, this could become quite meaningful.

Thank you for the write up. Enjoyed reading. What do you think about the cvr structure and viability?