RZLT (Long) Ph3 sunRIZE data 2H 2025

Prototypical small-cap rare disease run up candidate into high POS readout next year

One of the more consistent phenomenons I’ve observed in my time has been that small-cap late-stage rare disease companies can be completely discarded until the year before, sometimes even the year of pivotal data. There are some extenuating circumstances with a couple of these examples, but over the last couple of years, names like SVRA, KALV, CBAY, and LYRA come to mind. Obviously (unfortunately) LYRA failed, and of note, the rest of these traded so well into data that the performance of these stocks post-data is mixed at best. There’s more nuance than that required for say the CBAY topline for example, but this is just to give you some general idea of what I’m going for. Those types of companies trade tend to trade very well leading up to data, and if you’re correct in your assumptions, the readout should have a high probability of success. I think looking for this type of setup is one of the best ways to start building out core ideas for next year.

Now, that being said, I do think this phenomenon is becoming increasingly well-recognized, and may even be starting earlier. For context, the stock is already up ~400% YTD! The stock has traded well this year thanks to some combination of removing the financing overhang, the DME data fail/spin as a clearing event, the partial clinical hold lift and subsequent enrollment of US patients, as well as general interest in the CHI program with the readout coming next year.

~70M OS with the stock at $5 puts the market cap at about $350m here, with $118m in the bank while burning something like $10m/q, which likely increases a bit next year.

I don’t see this as a demanding valuation at all, considering I expect they’re very likely to read out pivotal data as a best-in-class rare disease drug next year, with a plausible expansion indication dataset due the following year.

Rezolute is running a pivotal study for congenital hyperinsulinism (CHI), and intends to initiate a pivotal study for tumor hyperinsulinism (THI) in the first half of next year.

Congenital insulinism can cause recurrent hypoglycemia, slow development, and even in some cases be life-threatening. The idea is simply that a prophylactic treatment that lowers these levels will lead to much less, or zero hypoglycemia. The current standard of care is diazoxide (label and data publication). There is no efficacy data on the label, but the linked publication (a retrospective European study) suggests that 47 patients of 114 studied responded to diazoxide treatment, which I believe is where the oft-cited ~40% responder rate comes from. This meta-analysis including more recent studies suggests the responder rate may be higher, though they still acknowledge the need for randomized controlled trials. Diazoxide is also black-boxed for pulmonary hypertension.

Additionally, it’s administered orally 3x daily, which I would imagine is not ideal, particularly for primarily an infant population. Although, that’s admittedly not something I have much familiarity with.

Rezolute frames their TAM like this:

They believe the majority of their market will come from diazoxide non-responders who have diffuse CHI, and therefore do not receive a pancreatectomy. The cure rate for focal patients who undergo the operation is >90%. The diffuse patients would still require treatment following surgical intervention, and the procedure requires a pretty lengthy hospital stay, so it’s not really a consideration for the majority of patients. I actually think RZ358/ersodotug could eventually overtake and/or be used in combo with diazoxide, to the extent that regulators and insurance will allow it. High-quality randomized controlled data on the depth of response in insulin levels as well as responder rates, dosing advantage w/ periodic injectable vs TID oral, and no black box. I think there’s a nice argument to be made here down the line.

But there’s other competition in the clinic as well. Zealand’s dasiglucagon has been CRL’d twice for manufacturing issues. This treatment is administered by continuous pump… you can find KOLs who will say this is fine from a convenience POV for long-term dosing, but I’m skeptical of that if a more efficacious & convenient treatment materializes. There are also issues with the efficacy data in my view. Zealand ran 2 dasiglucagon studies. One study (n=12) was run in an acute, short-term setting with 48 hours on placebo/dasiglucagon before crossing over for the other, plus a 3-week open-label follow-up. This study met its primary endpoint with a stat sig 55% reduction in IV glucose administration in the last 12 hours of the treatment period. This is what Zealand has applied twice and run into manufacturing issues for. Presumably, these will be resolved at some point. The drug will likely be used off-label for longer-term dosing, but the use case for this is murkier. In an open-label RCT, Dasiglucagon failed to show a stat-sig improvement on the primary endpoint of reducing self-monitored plasma glucose (SMPG) detected hypoglycemia from weeks 2-4 in a 4-week study. In a post-hoc analysis over the same time period, the drug showed a stat sig 43% reduction using the continuous glucose monitoring (CGM) detected hypoglycemia. They blame detection bias as a possible culprit in the publication. Zealand hasn’t filed for this yet, but I’d imagine n=16 arms with open-label & post-hoc data w/ a failed primary endpoint is going to be a tough sell.

Another company to monitor would be Amylyx (AMLX), who recently bought Avexitide out of Eiger’s bankruptcy. For now, they are pursuing post-bariatric hyperinsulinism but could emerge as a more serious competitor in the future.

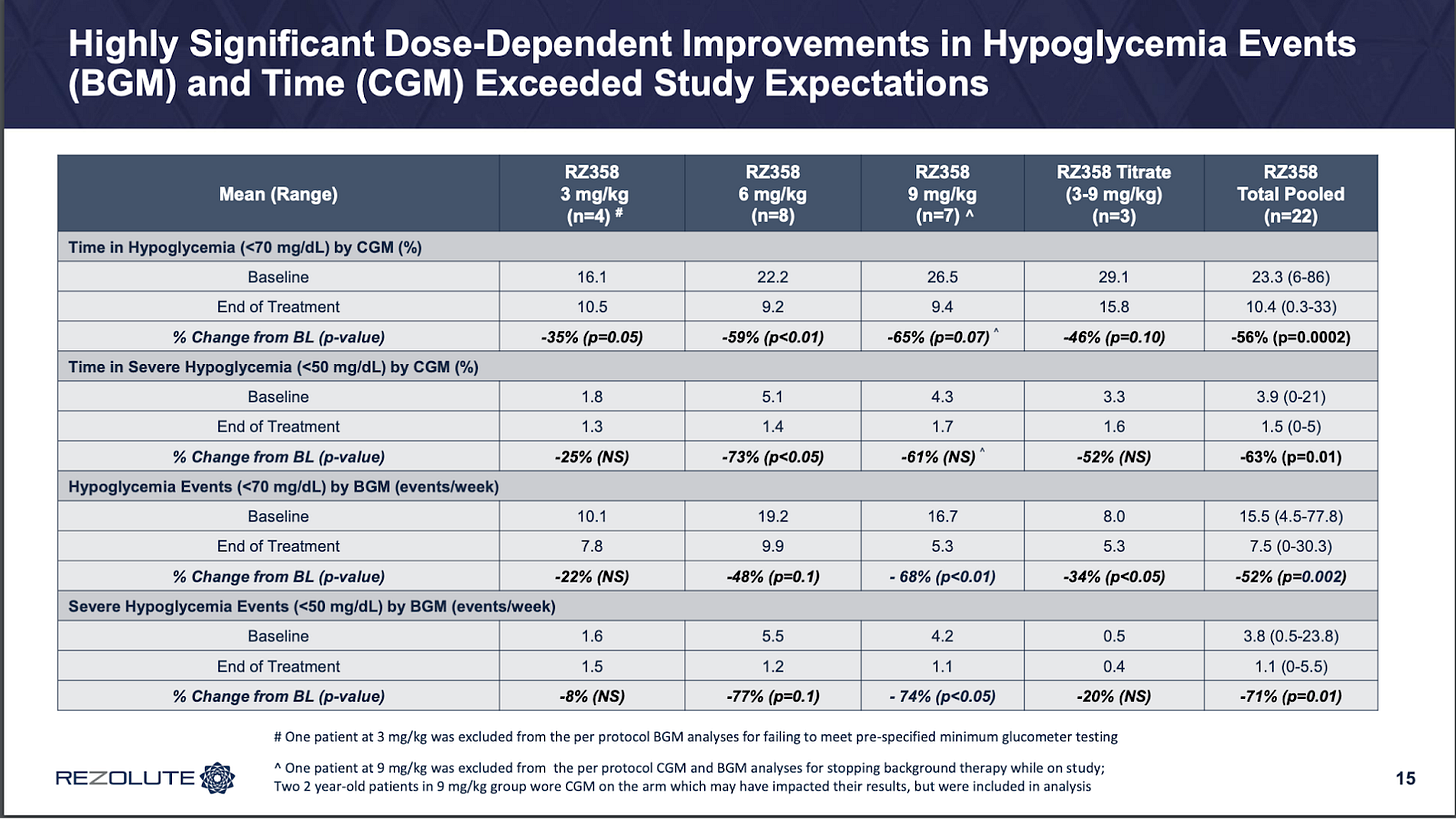

As for the RZ358 ph2 open-label data, it looks awesome to me.

Clear dose-response, no divergence depending on how you measure hypoglycemia whereas dasiglucagon did, and a deeper proposed effect size as well.

Great to see the entire high dose with a >50% correction, bodes super well for responder rate comp to diazoxide. The population also included a few patients with prior diazoxide use. The market agreed this was strong data at the time, as the company was able to raise around $120m off this back in 2022.

As for the ph3 design, there are a few differences to note. It’s a 24-week trial vs 8 in the ph2. Now dosing at 5 and 10 mg/kg (from 6 and 9), and loading doses to q4w (from q2w), plus the obvious open-label to RCT. These are obviously not risk-free changes, but I don’t see any particular cause for concern. The effect size seen is so large, and one shouldn’t expect much of a placebo response at all. The dosing changes should be fine as well with predictable concentrations and > 2-week half-life.

I think that given the effect size in the open-label data, and a lack of changes to the design that would introduce risk, this study is very likely to be positive, and I expect a similar effect size again. This should be a best-in-class drug, with rare disease pricing power, and meaningful opportunity to expand into Europe, and with tumor hyperinsulinism as well. I would note that the old retrospective study I linked before had a database of around 100 patients in Germany alone. The THI case study is pretty interesting:

They’re able to taper some of the other therapies, and eventually send the patient back home which is not very common. Glucose levels seem to hold at a much better level after a couple months of treatment. There’s a Slingshot call with one of the docs from the case study if anyone’s interested in learning more. The FDA is letting them jump straight into a registrational study, design is posted in the latest corp deck.

I don’t think this is in the stock at all, and I think it could start to get some attention after the first readout next year. This is one of my favorite ideas over the next couple of years, I think it’s hard to find companies that are this level of de-risked while still retaining material upside in the stock.

great write up!

How do you quantitatively think about the probability that they need to add additional patients to the study delaying the final read out?