Solidifying my CAPR view -- PDUFA Aug 31st

I expect a CRL

I’ve discussed my view on the clinical data before. I think the HOPE-2 mid-trial design alterations (sample size decrease) and stats modifications are highly problematic. They show a ton of different versions of the PUL scale with varying results, and the totality of LVEF data is very unconvincing to me. The market largely ignored this data for years, I presume for similar reasons. This was not trading well into the anticipated first HOPE-3 cut, I again presume for similar reasons. I acknowledged at the time that my view of the data did not matter because I am not Peter Marks. It still doesn’t really matter, as believe it or not, I am also not Vinay Prasad. However, I think this was purely a regulatory trade sparked by Peter Marks, who is no longer there. The DMD approval bar is one of the most obvious policy reversals to make, and this admin has clearly shown a general interest in reversing policies of the prior admin. This will be Vinay Prasad’s review, and the views of his predecessors no longer matter in the slightest.

I think the odds of this being approved are near zero after everything that has happened lately. STAT's reporting on the adcom cancellation and departure of Nicole Verdun is great, and could not be more clear-cut in my eyes. Out with the old way, and in with the new. The old way, very clearly approving DMD treatments based on limited, at best, evidence. The new way… not doing that. I don’t know how else one would possibly interpret this. The STAT reporting is very clear that Verdun left specifically over this decision, and I know Marks was perceived as an extremist by some in regard to the DMD approval bar. I don’t think there’s any serious debate to be had over who is on which side here in cancelling the adcom. To some extent, the market agrees, given the current ~75% borrow rate with no meaningful availability. To another extent, it does not, because the stock is still trading at $10, and will trade sub $2 at the end of the year if it’s rejected and HOPE-3 fails.

Additionally, I think the Sarepta controversy is a negative development regarding CAPR. While it could conceivably improve the commercial story, I think it makes the regulatory backdrop even tougher. If there weren’t already enough reasons to expect that scrutiny on DMD drugs would increase, this is just one more. It’s also a clear illustration of the risks in taking chances on approving therapies like this with mixed data. Granted, maybe it’s rare enough that it wouldn’t have been caught in a bit larger program anyway. But that being said, I don’t think it would be unreasonable to expect the agency to seek a higher efficacy bar after this in a vacuum, never mind all of the context behind the staff turnover.

I think that punting on the first HOPE-3 cut to get this filing in speaks volumes. Clean data would’ve spoken for itself. Instead, we’re here almost 9 months later with no clinical data, and it’s unclear if any of it will be available to inform the decision. This would be much more convincing evidence than anything else they have in the package. I would also note that if this were to get rejected, and they have to file again after this with full HOPE-3 data, it’s probably even a slower process in total. This is a very high-risk pathway, one that I think is best taken by a company that doesn’t believe a positive RCT outcome is likely.

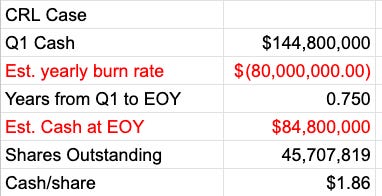

Most of the decision inputs that I think are worth discussing here are at least partially timing-related. Will the decision come on time? Will it come with or without HOPE-3? When does HOPE-3 data come, if not prior? STAT says probably end of summer. That would track with 3-month data estimated for the end of last year, and this being 12-month data. I think an on-time CRL is the right assumption, with data likely in Q3, but it’s not a given. I think that after both that and data, the stock would trade sub $2. I have them at about $2.44 in cash at the end of August.

I don’t have a feel for how to handicap the odds of a 3-month extension, particularly with the confounder of HOPE-3 around the corner, so my preference is to avoid doing so. Given that, my preference would be for the December or January puts, to be a bit safer. At the end of the year, that looks more like this:

Something like a $1.50 target for the end of the year would be in the right ballpark, which is the stock down ~85%. The other problem with targeting specifically the PDUFA, how do you value the stock while it’s in limbo with a CRL but no HOPE-3? Are people happy to cover at say $4? Does the cult buy more? How many negative EV stocks have an imminent (low PoS of course) catalyst that could genuinely move the stock 5-10x if positive? So it’s likely trading >$2.50, right? I think selling very OTM puts for Sept could make some sense, but it’s hard without concrete data timing. Even for me by myself, I’m having a hard time with the trade structure here, which is rather uncommon. I am leaning toward puts that extend beyond the 3-month extension margin, or spreads without the extension margin, but I don’t think there’s a clear and obvious answer. It might be more of a liquidity-driven decision than anything. I see enough upside to be interested, but the pricing will require some strong conviction already.

As for the bull case, I guess you’d look at the Sarepta controversy and say that the market is potentially clearing up, but I have genuinely no idea how you would feel remotely good on the regulatory side. Even if approved, they only have a 30-50% (???) royalty.

In my view, this is an odd way to present a very material number. These are extremely different numbers:

If the stock trades to $35 on approval, does that imply the drug is worth something like $4.5b, or $7.5b? It’s ridiculous. You can just take the midpoint, but then why don’t they just say 40%? There’s no competitive advantage preserved or anything like that, and this is a much wider difference than your usual vague “low single-digit” royalty language. I would guess it’s because the number starts with a 3, and they are playing it up with the range rather than down, but I sure don’t know that. There are some caveats with this math, like they also have some regulatory and sales milestones that I’m not factoring into the total implied valuation, but this is just for a rough visual.

To conclude, I don’t like anything that has developed here since the election. To me, this was purely a regulatory/political story that has since completely broken, and yet is not trading as such. I feel very strongly that this will get rejected, and I look forward to seeing the outcome later this year.

Great write-up, thanks!

good write up, I used to love the peter marks trade, got a rare fatal disease state and a therapy well sir you now are able to use your p1/2 with no controls for the AA pathway. I've stopped playing the trade with pm's departure. I was long capr twice and have exited. If VP does miraculously approve this therapy I will 100% go back to investing in qure, lexo and others. I see this as kind of a litmus test. However for my risk profile, and due to the cost of shorting it I'm on the sidelines with popcorn.