I’ve never been a VERV guy. I think the commercial story here is tough. Convincing cardiologists, or really anyone, that a gene therapy for a well-met need is a safe and strong option… will be a real challenge in my view. Merck has a once-daily oral that reduced LDL-C by 60% placebo-adjusted in phase 2. They recently disclosed that their first phase 3 study was positive, though full results have not been shared yet. Inclisiran is a quarterly subq treatment with a 52% placebo-adjusted LDL-C reduction in phase 3 on the label. Verve-102 will always have a convenience benefit, and any reasonable person would conclude that the therapy works (see usual ~0% placebo response in the studies linked above). Additionally, the above populations that I’m comparing are not exactly the same, and the Verve later stage data may not look exactly the same either. That being said, there are very real risks with using any gene therapy. Putting those up against drugs that work similarly well, or even better, in an indication this well-serviced is not my cup of tea. If they can get it over the finish line, props to them, and I’m sure some people will be happy with the convenience benefit offered. I just have a hard time seeing this become a blockbuster and/or a commonplace way to lower LDL-C.

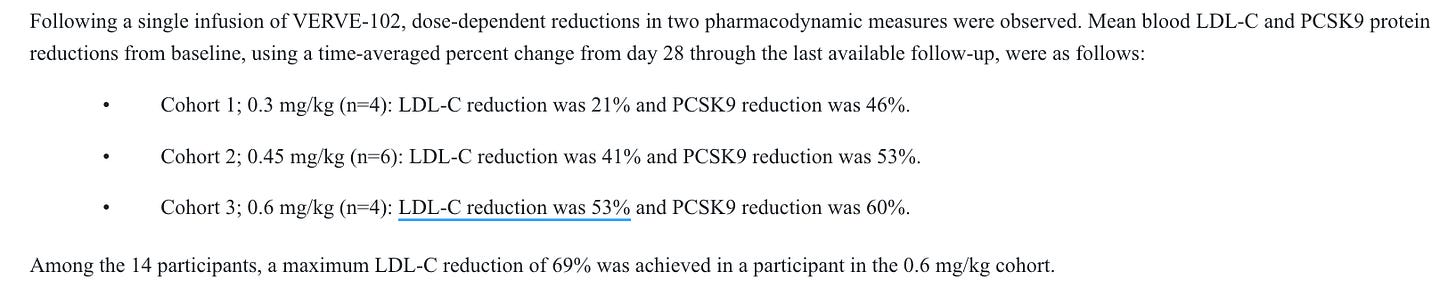

However, I digress, because effectively none of this is my problem anymore. The folks at LLY have doubled down on their investment here by buying the company, indicating that they disagree with my view and are happy to move forward with the efficacy data that Verve has already shown. Which is fine, that’s what makes a market, and there’s plenty that I don’t know. The only big picture question that matters here is whether or not dosing a phase 3 program is viable, as that is what will pay out $3 in a few years. I do believe that this milestone will pay out. I think LLY is making a clear commitment here to a program that has demonstrated clear efficacy POC through a dose-response and a competitive high dose LDL-C reduction. Admittedly, it’s only n=4, and at least in large part thanks to this one 69% responder:

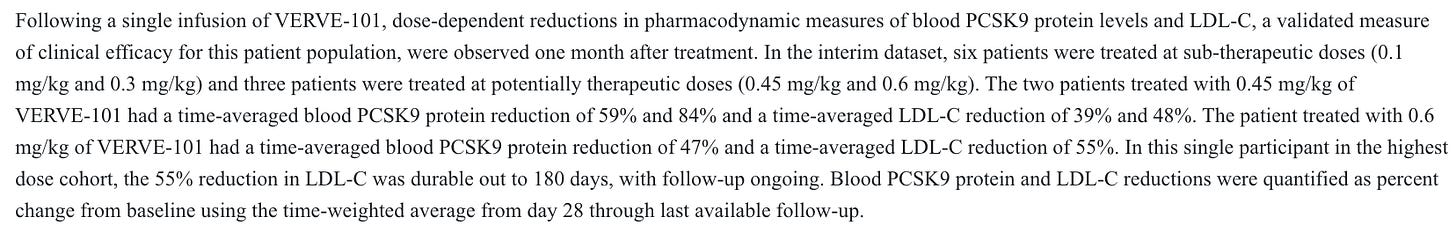

This is at least reasonably competitive data. I think it’s fair to assume that the LLY folks are interested in the dosing profile, and not that they expect it to be best in class, so a marginal degradation of the efficacy data in phase 2 would likely be trivial in my view. We also have efficacy data from the first-gen candidate, Verve-101. This candidate showed similar efficacy, with the 0.45 and 0.6 mg/kg doses showing LDL-C reductions in the 40’s and 50’s % area at even smaller n’s than for the 102 candidate.

Given the complete lack of placebo response generally seen on LDL-C, I think it’s fair to say that this is very likely active. The dose levels perform similarly across both trials, despite the small samples, I am comfortable expecting them to perform similarly moving forward. If 0.7 mg/kg ends up being safe enough to advance, they may even be able to show a deeper effect than what we have seen so far. Which brings us to our next issue, safety!

First, the FDA placed a hold on the IND before they had even started dosing in the US.

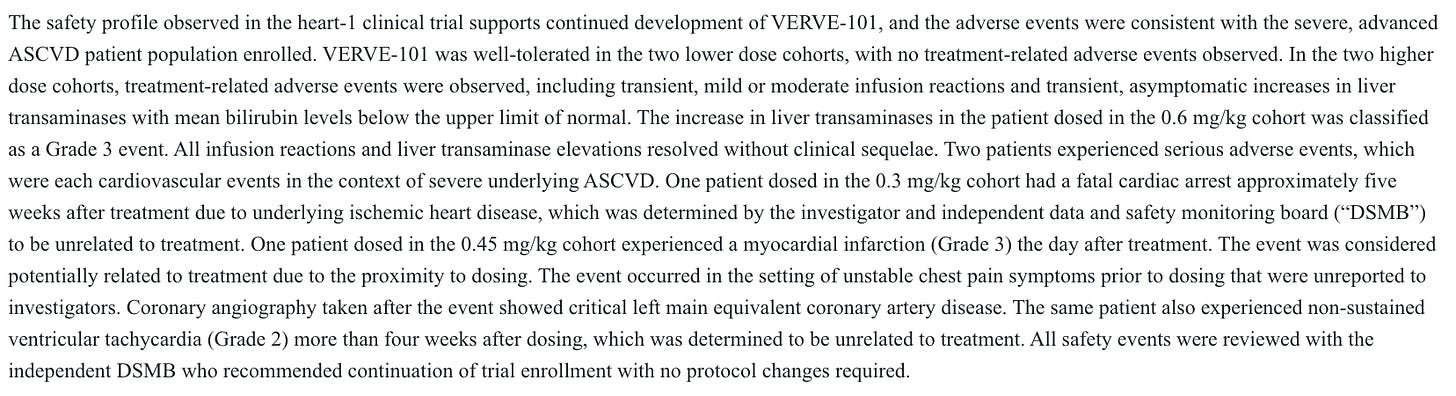

Importantly, with the 101 candidate, there were multiple safety issues observed at both therapeutic and non-therapeutic dose levels.

A G3 liver AE was deemed treatment related, and a G3 myocardial infarction the day after treatment was considered potentially treatment related, and that was at a non-therapeutic dose level. Given how few patients were dosed, this was quite problematic at the time. Months later, the company paused enrollment and looked to advance the 102 candidate instead after more AE’s at a therapeutic dose level:

They believed that changing the delivery system would make it much safer, as they explain above. Through the n=14 data from 102 so far, which includes the 0.45 mg/kg dose that caused all sorts of problems with 101, as well as 0.6 mg/kg, their thesis has held true so far.

One G2 infusion-related reaction that resolved with Tylenol through n=14 is great safety data for any gene therapy, never mind one with the slew of issues associated with the first-gen candidate.

There remains some risk on this front. Sarepta just unfortunately showed us that you can dose many times more patients than Verve has, and still not fully grasp the safety profile of a gene therapy. Dosing more patients, at higher doses, and following them for longer may tease out events that we have not seen yet, but I don’t think there’s any cause for concern in the 102 safety data generated to this point.

Putting this together, we have a candidate that is very likely to work. LLY has made a recent financial commitment to the program based on the existing efficacy data. The existing safety data doesn’t generate any real cause for concern. I think this is more likely than not to advance to phase 3. The company plans to begin dosing for the phase 2 later this year, and they guide that their cash balance lasting mid-2027 will include completion of the phase 2 trial.

This seems reasonable with the FDA clearance, which will help them speed up enrollment. This likely sets up phase 3 dosing for 2028 or 2029, I assume 2029 to be conservative. And I view that as more likely than not (>50% POS) to occur.

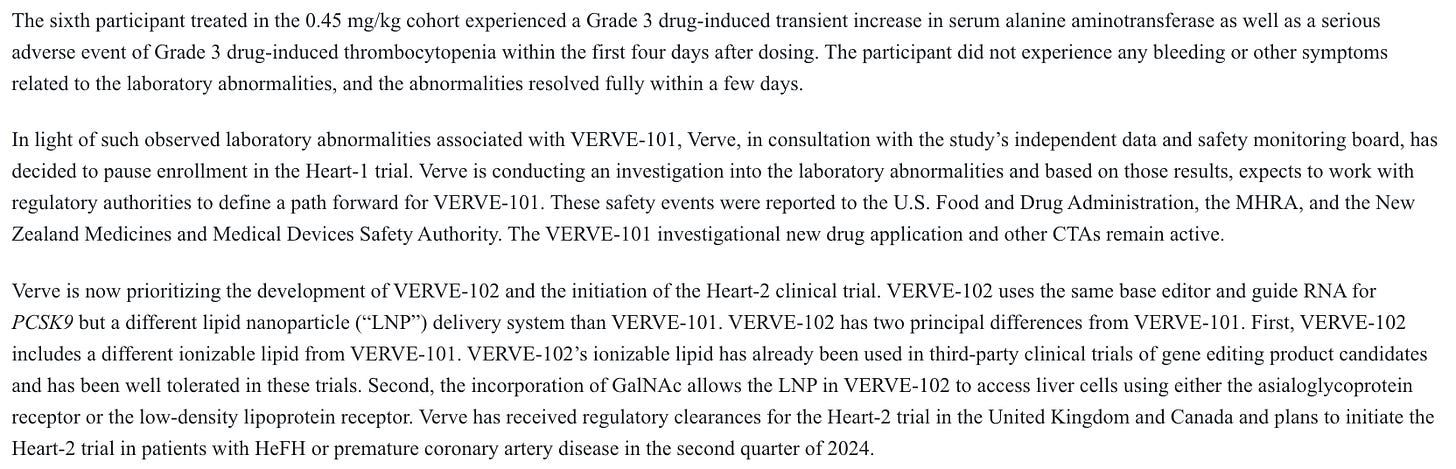

The CVR terms give them 10 years to dose the trial, so plenty of room for regulatory issues/clinical hold or anything of that nature. As long as it’s resolvable, of course. There’s also a possible 0.50 reduction for possible patent/licensing issues, which I have no view on. For my calculations, I assume the CVR will be worth $2.50, and if it’s worth $3.00, then that’s great! Discounting this back for 4 years at 10%, with a 50% POS, I get a fair value of $11.36 vs. around $11.00 right now. That would value the CVR at 86 cents and not 50. The tender offer expires on July 23, so the deal should close this month. I don’t foresee any closing risk, nor am I modeling any opportunity cost for tying up the other $10.50 for a week or so. Feel free to do that on your own time if that’s what floats your boat, I suppose. The rest of the table with varying POS assumptions under the above conditions would look like this:

If you want to get more aggressive on timeline (3 years) and assume the full $3 payout, that would put the CVR at $1.13 for a 50% POS. Not sure there’s a particular reason to do that, but I don’t think it’d be wildly off base either. The specific degree to which this is undervalued may not be entirely clear, but I believe that it is, and that the math here is rather workable.

I think the story for why this would be the case makes sense as well. This historically hasn’t been the most popular stock, my commercial take at the beginning is far from contrarian. CVRs are almost never popular to begin with anyway. They are inconvenient, illiquid, and some people have to waste time marking them. CVRs that people have to pay some premium for will have even lower interest, because you price out the merger arb folks without a healthcare background. People who didn’t own the stock probably aren’t super motivated to take another look, for any or all of the above reasons.

I think this ticks a lot of boxes for me, has a reasonable story for why it’d be undervalued, and is likely to pay out in a few years. I’m personally happy to tie up capital in something like this for a week or two, and then deal with the illiquidity of a small position carrying over for a few years. I think that’s a reasonable trade-off to make for a likely payout.

Interesting at 10.92, 30% return if it hits in 2029. Wonder if it's worth risking that for the liquidity. GOod post. I do think it hits but it's always boring waiting for these lmao