VYNE has already run up a lot this week, so let’s get right into it. VYNE has a topical BET inhibitor for non-segmental vitiligo. They are running a ph2b RCT, which should read out mid-year. I expect that readout to be stat-sig positive. How positive (vs. SOC comp) and how to value that are a bit more uncertain, but I’ll get into all of that later.

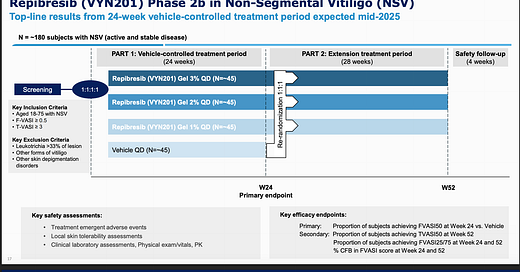

As you can see above, it’s a 24-week trial, and enrollment completion was PR’d January 6th. 24 weeks from that time is this week, so I would imagine the readout is probably in August, definitely within Q3. The primary endpoint is FVASI50 at week 24 vs vehicle, which I have no issues with. This will be directly comparable to the standard of care, Opzelura. That’s the first and only drug currently approved for vitiligo. It’s a topical JAK inhibitor applied 2x daily, and comes with the typical JAK black box label.

Vitiligo is essentially the depigmentation of skin. Here are a couple of examples:

The skin doesn’t become irritated, and it causes no physical harm. People can still be motivated to seek treatment for things like this, as there’s absolutely a personal, social, and psychological impact. However, you can see why a 2x daily topical that is black boxed for infections, mortality, MACE, malignancy, and thrombosis might not crack the market wide open.

Incyte commented in Q1 2024 that the split between vitiligo and atopic dermatitis sales is about 60:40 in favor of atopic dermatitis. They are guiding for $650m in sales this year. If that ratio still holds, it would mean around $250m in vitiligo sales for a market they have had to build out themselves after approval in July 2022.

VYNE believes that many patients still don’t seek treatment, and they note that sell-side estimates are more like $500-750m peak sales.

VYNE argues that their place in the market is as a once-daily topical that is unlikely to be black-boxed, and that since this is generally a localized disease rather than systemic, systemic JAKs aren’t a great fit either. I don’t have extremely strong feelings on this one way or the other, but in my eyes it’s at least reasonable. Excuse any typos in the transcript. Quartr is the best I’ve found for a free tool, but not perfect.

In my view, between 1x daily dosing benefit, possible 1L use, possible adjuvant to systemic JAK, non black-boxed alternative to topical JAK, and being an alternative MOA for any JAK non-responders, that’s at least enough of a use case to obtain funding on reasonable terms after positive data here, and probably enough to have a shot commerically as well.

I think even after running up the last few days, this would still go higher on data that is stat sig positive but worse than Opzelura. 16.7m shares + 26.8m pre-funded warrants is 43.5m OS * stock @ 1.70 is about $75m market cap, and the company has $50m cash into 2H 2026. The ph3 program would be quite derisked, and just on being an alternative to Opzelura with a dosing benefit, I’d figure this could conceivably do $200+ million in sales… Obviously won’t realize all that value out of the gate here, but I think something like $100m EV after data wouldn’t be a huge ask? That would put the stock in the 3’s, pre-dilution at least. I have more confidence in positive data than I do in seeing high interest in the stock for favorable financing. If the stock didn’t trade this well after the data, I don’t have much of an interest in trying to hold out for more later. But I don’t view it as too optimistic either, if that makes sense.

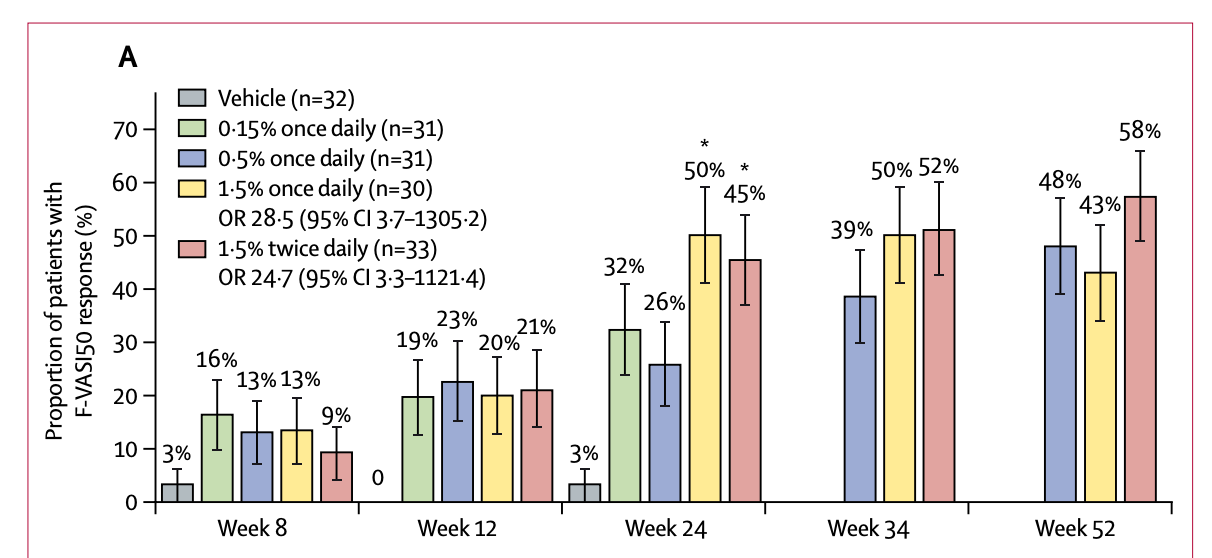

The Opzelura ph2 publication shows 45-50% FVASI50 responders, with a murky dose-response, and little to no placebo response. The baselines also show that the majority of the patients have progressive vitiligo, which differs from the ph3 and makes it more comparable to VYNE’s POC data, which had no stable vitiligo patients.

The ph3 data on the label shows a bit higher placebo response, but still rather minimal, though it’s also FVASI75/90 and not 50. This was a bit surprising to me, as I would think it’s quite difficult to placebo your way into durable skin repigmentation over a 6-month period.

Given that this a ph2b with an FVASI50 primary endpoint, though they are also collecting 75, I think it makes the most sense to compare to the ph2, which would put the bar at 45-50% FVASI50. This is what makes things a bit more challenging… I don’t expect VYNE’s drug to beat this. Their treatment appears to be active, as it shows a nice dose response on mean VASI. There’s no placebo arm, but the lowest dose generally behaves like you would expect a placebo to. As previously discussed, I would anticipate low/no placebo response, which makes the mean responses and FVASI50/75 responders reasonably impressive. I think it’s important to note the slope here. Almost all benefit on mean FVASI occurs in the first 8 weeks, with a marginal (<5%) decrease in mean FVASI in the following 8 weeks. Generally, you’d hope that going to a 24-week trial would result in meaningfully deeper responses. I worry this may not be the case here, at least at the 1 and 2% dose levels. Both show responder rates around 30%, which is, you know, meaningfully less than 45-50%.

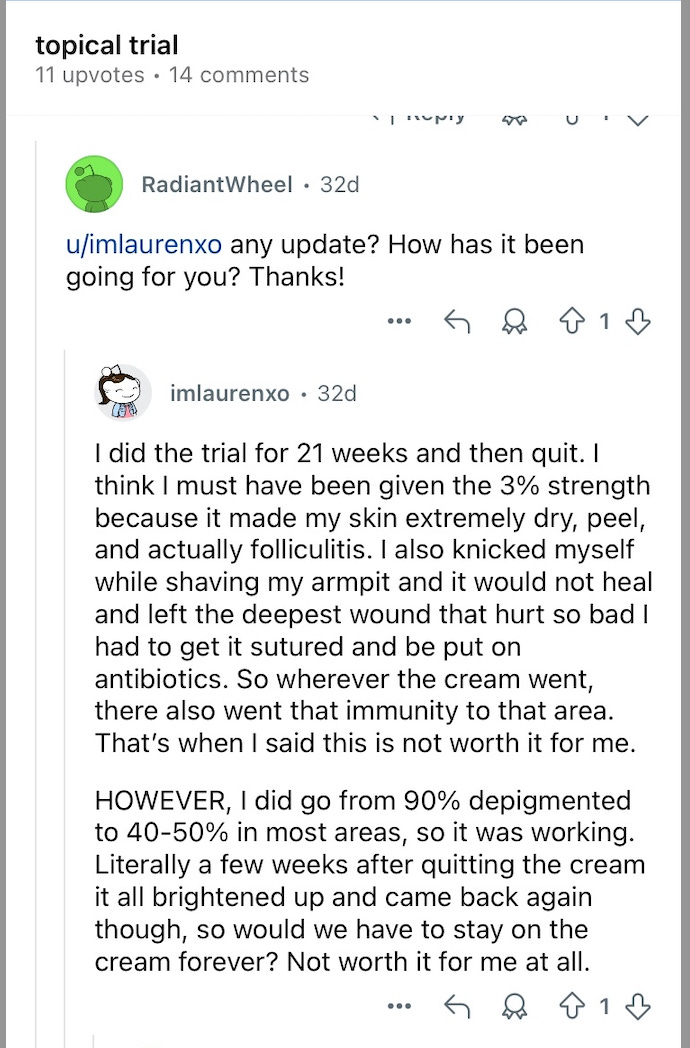

There is at least a 3% arm in the ph2b, which could show more responders, particularly if the mean decrease were to be near 50%, which is possible based on the POC data. A previously untested dose like this, however, could have some safety issues. Take this with an appropriate grain of salt, of course, but there are vitiligo Reddit anecdotes suggesting this may be the case.

Taken at face value, this is a patient who discontinued for safety, despite seeing a meaningful efficacy response, and believes they may have been given a higher dose (for whatever that is worth). Given the presumed low placebo response, this is marginally supportive of drug activity (though early drop out won’t be recognized as a responder), not great for safety (though not on par with JAK issues of course). If this ends up worse than Opzelura and yet still has patients discontinuing for safety issues, the commercial picture seems rather murky. If this is a one-off, and 3% generally works better than Opzelura, I think they have something here. If safety issues are relegated to the 3% dosage, and 1-2% are vaguely comparable (>40% responders? Maybe any stat sig %?) with the benefits previously mentioned, I think they have something here.

They over-enrolled the trial, I expect little to no placebo response, and treatment arm responses (longer duration, new highest dosage) should get at least marginally better. So to that end, I don’t see any issues on the stats side, just with whether that’s the bar or if Opzelura efficacy is.

To summarize, I think this makes sense as a run-up candidate (small stock, high POS readout). I’m just a little bit more hesitant on the bar, but I think the bull case makes enough sense to take a stab at it. Would love to hear feedback on the bar or anything else here, feel free to let me know what you’re all thinking!

That reddit find is interesting to me. Made me nervous about potential safety issues as the drug accumulates in the skin.

the same argument about deepening efficacy could apply to the safety too. So they hvae a 50% F VASI response at week 16-24 (from the patient and Early data), but the “deepening effect” is attenuated by dropouts.