GALT (short) Ph2b NAVIGATE data December 2024

Pretty standard longshot based on a post-hoc subgroup

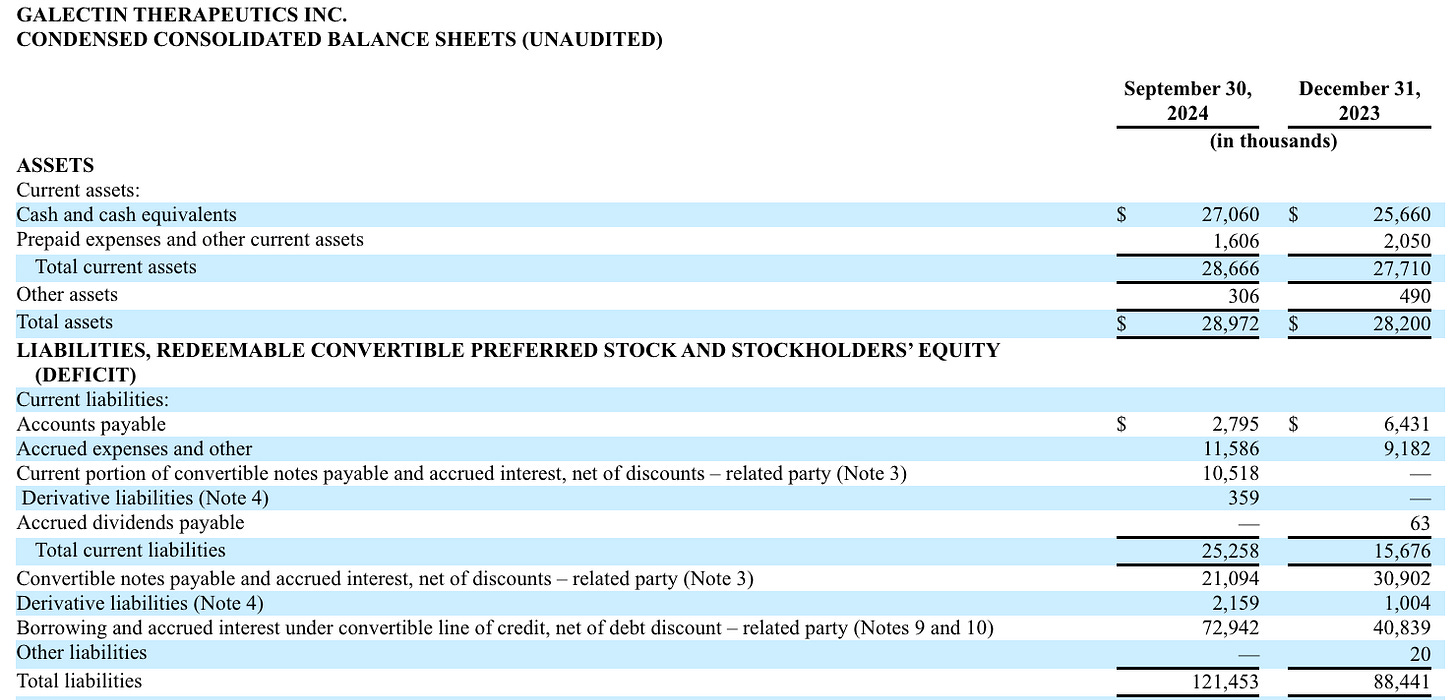

It’s increasingly challenging to find ways to add to this trade given how in-demand it seems to be, but I still want to put my thoughts in writing before the readout sometime later this month, I’m not sure when exactly. This might be my favorite RCT short ever so far. Usually, I can come up with at least some minor issue (beyond the standard binary nature of these types)… is there some reason the stock might trade to ~0.75 vs <0.25, if it’s an interim is there a way they can punt & other forms of timing risk, is there material risk that the stock responds favorably or at least well-enough to subgroup analysis, etc. I have no such concerns here. The balance sheet is a mess, their chairman (who runs a family shipping empire??? — not an industry guy) has a bunch of convertible notes that expire next year with a strike at many times over what the stock will trade at on a fail.

They would need a TON of funding to run any further subgrouped trial, and the stock should really have no residual value if they report a clean fail. The company also reiterated their December timeline (maybe even moved it up a bit within December?), and declared their intention to topline the efficacy data as a stand-alone trial at Q3 earnings.

The trial design is a fixed duration endpoint, it’s not event-driven or anything like that. Enrollment was completed long ago, there are no foreseeable timing issues of note. I think that just about sets the scene, it’s a pretty simple setup. I also find the data analysis here to be incredibly simple. They almost give you enough data in the corp deck alone to make the call… In the prior belapectin trial, both arms failed on the primary endpoint. Also note the y-axis chart crime.

They examine a subgroup (patients without varices) which is stat-sig at the low dose, which they claim is positive, and shows no discernible benefit at the high dose (p=0.44).

They also try to show that belapectin may reduce varice development, though there is again no dose-response and the high dose is not stat-sig.

The full publication is available as well, but as you can see, even as far as post-hoc data goes this is very low quality. A U-shaped dose-response and no discernible effect on the old primary endpoint. The publication shows that both dose levels on the primary endpoint were p=1.0, which is rather spectacular…

In the discussion, they also mention that no central read could render the varice findings (which again I don’t find compelling to begin with) unreliable, and that it’s rather peculiar it doesn’t correlate to any other change in fibrosis.

The new trial is set to measure the change in varices as the primary, with central reading, which should reduce variability. And a much larger sample, with no clear path to slicing it up further.

I find the proof of concept data to be completely nonsensical, with no dose-response, near-zero proposed effect on traditional NASH endpoints, the acknowledged variability from no central reading for varices, and the low-quality nature of a small post-hoc subgroup. I don’t find it surprising that this has clearly become a popular trade, or that the only person willing to finance the operation is some random shipping tycoon. There’s even more of a bear thesis to dig into if you follow the drug and its development from further back… but you really don’t need to. I think at its core this is a very simple thesis, and I look forward to the readout sometime later this month.

Nice work! Another thing to add is that the reduction in HPVG observed is likely not clinically significant enough (need to reduce by more than 20% to see clinical effects).

Just wondering if you would recommend the 20 Dec Puts vs Jan puts, which are nearly pricing in the company's bankruptcy by Jan.... Unless the company chooses to do the readout on Christmas week?

Thanks for the great read!

One minor point: the company may still trade above $1 in Feb '25 if R. Uihlein wishes so.. You mentioned the following: "it has a bunch of convertible notes that expire next year" Well, the thing is RU has already "irrevocably agreed" to convert the notes expiring in the mid of next year (at $5 stock price!!) so the ones that left expire in Sept.. Add to this the fact that almighty Dr. Ben Carson is on their board and this becomes a feasible spin for retail